Affordable Housing Needs in the U.S.

• Rising home prices and mortgage rates have made purchase costs more expensive.

• To restore affordability, steep declines in home prices and mortgage rates, along with increased median household incomes, are required.

• The U.S. has been building fewer homes than needed since the Great Recession.

To achieve affordable housing, home prices must decrease by 40%, the average mortgage rate must drop to 2.45% from 6.80%, and the median household income must increase from $77,730 to $129,096. A combination of these factors would suffice.

Home affordability has significantly risen since the pandemic, with first-time buyers facing double-whammy of surging prices since 2020 and high mortgage rates since 2022, pushing monthly mortgage payments on typically priced homes out of reach for all but high-earning buyers.

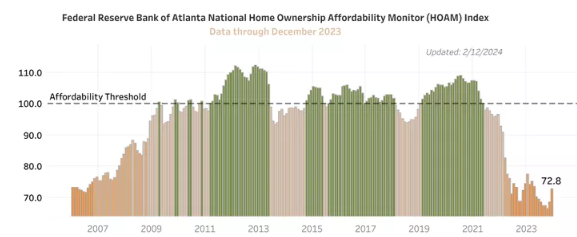

The Federal Reserve Bank of Atlanta’s home affordability index reached its lowest point since 2006 at 72.8, with 100 being the level of affordability at typical incomes. The index was at 106.7 in February 2020 before the pandemic affected prices, incomes, and mortgage rates.

As of December 2023, a median-priced home’s monthly mortgage payment, including taxes and insurance, consumed 41.2% of a typical household’s income, requiring a six-figure income to meet the standard 30% affordability threshold for housing.

Facing Reality

Housing experts predict that the current housing crisis is unlikely to improve soon, as lower mortgage rates could increase demand for housing and raise prices, despite the Federal Reserve’s easing of anti-inflation interest rate hikes.

Lawrence Yun, chief economist at the National Association of Realtors, suggests that the housing market’s issues stem from the US building fewer homes than needed since the Great Recession, with 5.5 million homes less than needed as of 2021.

The White House has released policy proposals aimed at increasing the supply of affordable housing. The best scenario is home price growth being less than income growth, allowing affordability to improve after three years of decline.

Steps

The measures would use federal grants to encourage local governments to change zoning laws that restrict new housing construction.

Lance Lambert, editor in chief of Real Estate Club, analyzed the global affordability of homes post-pandemic. The calculations assume monthly mortgage payments based on a 20% down payment and only consider principal and interest payments, leaving out insurance and property taxes.

The median-priced home cost $264,833 in February 2020 and has increased to $359,000 as of December 2023, according to CoreLogic’s three-month moving average.

The average 30-year fixed mortgage rate in December 2023 increased to 6.80%, resulting in a monthly principal and interest payment of $1,872, up from $956 before the pandemic.

However, incomes have not kept up with home prices, with the median income at $77,730, up from $65,868 in February 2020.