Fed Meeting Preview:– The Federal Reserve is expected to maintain its 23-year-high interest rate due to moderated inflation and a softening job market. Market participants anticipate starting the fed funds rate cut in September.

Interest Rate Decrease Anticipated, Timing Still Uncertain

- Federal Reserve officials are expected to maintain key interest rate steady at their next meeting.

- Despite some economists suggesting July as the ideal time to cut, financial market participants anticipate an outside chance of just 4.7%.

- Inflation has continued to decline, with some economists suggesting a further meeting to prevent reacceleration.

- The economy is becoming increasingly vulnerable due to slowing growth and rising unemployment.

- Exogenous shocks like geopolitical conflict or market selloffs could damage the labor market and consumer confidence, negatively impacting personal income.

Fed Officials Expect September Rate Cut

- Expected to be more explicit about the Fed funds rate cut at its September meeting.

- Fed officials are encouraged by steady inflation fall but waiting for more data before committing to rate cuts.

- Expected to keep policy rate unchanged in July while signaling progress on reducing inflation.

- Chief U.S. economist at Bank of America Securities, Michael Gapen, suggests cuts are likely in the near term but not a done deal.

Fed’s September Meeting Could Be a Turning Point for Economy

- The Fed’s September meeting could be a turning point in its fight against inflation.

- This would be the first reduction in interest rates since the pandemic in 2020.

- The Fed held the rate near zero during the pandemic to stimulate the economy.

- In July 2023, the Fed raised the fed funds rate to its highest since 2001.

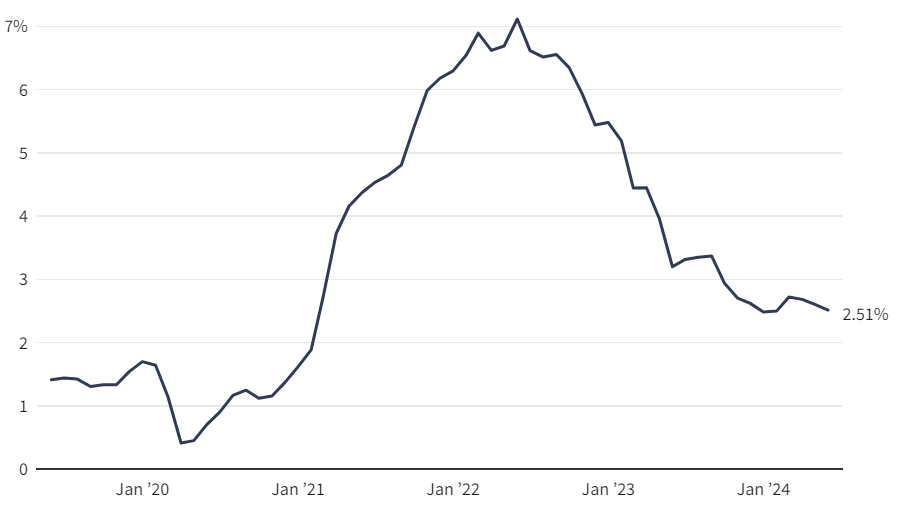

- The annual inflation rate has fallen to 2.5%, nearing the Fed’s goal of 2%.

- The unemployment rate has cooled, with the unemployment rate rising to 4.1%.

Inflation’s Slow Descent

Inflation reached its peak in June, but progress has been slow this year, with the Federal Reserve aiming to return it to its 2% annual goal.

Fed chair Jerome Powell expresses increased concern for job market and inflation, suggesting a shift away from inflation-fighting mode to maintain low unemployment rates.

Must read book about investing – check here Fed Meeting Preview Fed Meeting Preview Fed Meeting Preview