Stock Analysis:-Best low price shares to buy today – AGCO Corporation (AGCO).

CHECKOUT HERE :- Next Good Swing Trade Stocks With Target & Stop Loss

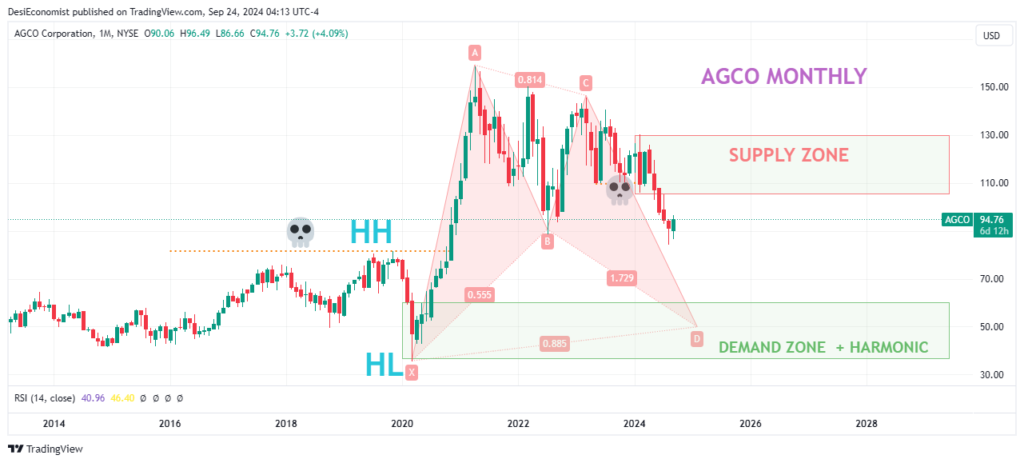

Investing in low-priced, high-potential stocks can be a powerful strategy in the stock market. One of the best low price shares to buy today is AGCO Corporation (AGCO), currently trading at $94.76 as of Monday, September 23, 2024.

With a history of significant price movements and favorable technical setups, AGCO offers an exciting swing trade opportunity. In this detailed analysis, we will break down AGCO’s technical indicators, key price levels, and the reasoning behind why it could be a top choice for traders and investors.

AGCO Corporation (AGCO) Overview and Trade Details

Trade Details: On Monday, September 23, 2024, AGCO Corporation (AGCO) closed at $94.76. The stock has been following a higher high-higher low (HH-HL) pattern on the monthly timeframe, indicating a long-term bullish trend. However, the stock has recently started a retracement from its all-time high of $158. It is now in a correction phase, with potential support at the March 2020 demand zone around $35.

On the weekly timeframe, AGCO has formed a lower low-lower high (LL-LH) structure, signaling a short-term bearish phase. Notably, the stock price collected stop-losses around $88 in August 2024, suggesting that traders have already shaken out weak positions, possibly paving the way for a price bounce in the coming weeks. With bullish divergence showing on the weekly RSI, the stock is poised for a potential upward move.

AGCO’s current price action and technical setup make it one of the best low price shares to buy today. Let’s dive deeper into the reasons why.

Uncompleted Bat Harmonic Pattern

A key technical feature on the monthly chart is the uncompleted Bat Harmonic pattern. The harmonic pattern is expected to complete around the $50 level, offering an additional area of interest for traders watching for a potential reversal. Harmonic patterns like this often signal price exhaustion, making AGCO a promising candidate for swing traders.

Swing Trade Setup: Entry, Stop Loss, and Targets

Buy Swing Trade Idea

Buy Entry Range: $93 – $89

Stop Loss: $86.50

Target 1: $102

Target 2: $110

CHECKOUT HERE :- Next Good Swing Trade Stocks With Target & Stop Loss

Weekly RSI Showing Bullish Divergence

One of the standout indicators for AGCO is the bullish divergence on the weekly RSI. As the price made lower lows, the RSI started to show higher lows, indicating that bearish momentum is fading. This divergence suggests that the stock is oversold and may be due for a rebound, reinforcing its potential as one of the best low price shares to buy today.

Conclusion

AGCO Corporation offers a compelling swing trade opportunity at its current price. With clear technical setups, favorable risk/reward, and strong support levels, AGCO is one of the best low price shares to buy today. Traders should keep an eye on key price levels and manage risk appropriately to take advantage of this potential bounce.

Read More Information About US Stock Market

Note: Always remember: risk no more than 1% per trade.” Keep trailing your stop loss to secure bigger profits.

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join Free our Discord community , Join Our Whatsapp Group

Our Articles on Long-Term Stock Analysis My best read on trading is this Book All Swing Trades Idea’s Here