Canadian housing market remained mostly unchanged in March 2024, with sales activity slightly up but below the average for the last decade. The national composite MLS Home Price Index remained unchanged.

Canadian Consumers Signal Possible Shift to Buyer’s Market

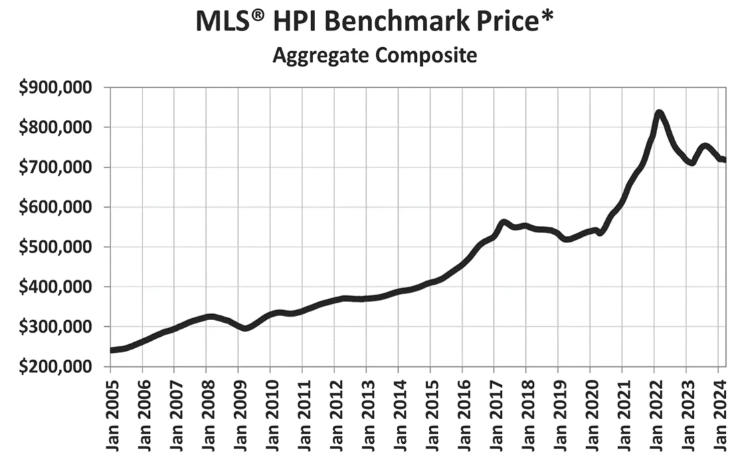

The Canadian housing market is likely flat, indicating tapped-out consumers. To reach pre-COVID affordability, prices, incomes, and interest rates need to fall, with a 33% drop in prices, 55% rise in incomes, and 350 basis points fall in interest rates.

The Canadian real estate market is expected to recover due to increased new properties, reducing excess demand, and a buyer’s market, with the full impact expected in April.

Increase in unadjusted transaction count

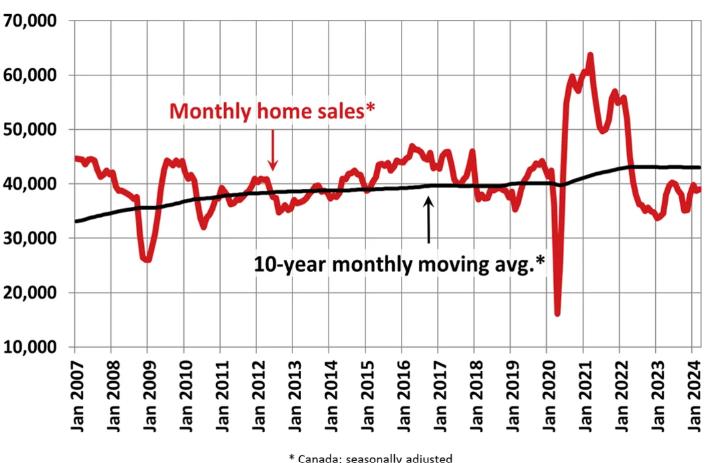

March 2023 saw a 1.7% increase in unadjusted transaction count, attributed to sluggish market conditions during Easter weekend. However, monthly home sales have not returned to their 10-year average, indicating unaffordability and economic factors preventing Canadians from buying homes.

Price activity

The price activity during the spring market of February and March was surprisingly underwhelming, with prices moving slightly downwards, a trend that usually occurs during these months.

The biggest increases in price were observed in the following locations.

Greater Moncton: +5 per cent

Estrie, Quebec: +3.5 per cent

Prince Edward Island: +2.7 per cent

Sault Ste. Marie, Ontario: +2 per cent

Chilliwack, British Columbia: +1.9 per cent

The biggest decreases in price were observed in these locations.

Simcoe & District, Ont.: -2.3 per cent

Mauricie, Que.: -3 per cent

Halifax: -1.7 per cent

B.C.’s Interior region: -1.6 per cent

Owen Sound, Ont.: -1.2 per cent

CREA’s 2024 forecast

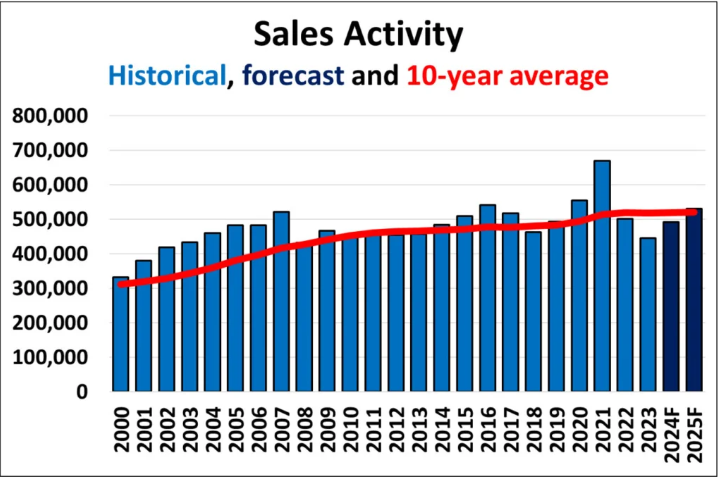

The Canadian Real Estate Association predicts a return to the 10-year average sales volume growth trajectory by 2025, with interest rates influencing Canadian housing markets through 2024 and 2025.

The first rate cut in 2024 is expected to occur in the second half of the year, with financial markets predicting around 50 basis points of cuts. Economists believe Canada won’t cut until the next Federal Open Market Committee meeting. The market is expected to recover, with 492,083 residential properties expected to trade in 2024 and 530,494 units in 2025.

Increases in volume

CREA’s 2024 forecast shows the biggest increase in number of homes sold to take place in:

Alberta, by 13.6 per cent

Nova Scotia, by 12.7 per cent

Ontario, by 12.6 per cent

Quebec, by 11 per cent

Increases in price

CREA’s 2024 forecast expects the biggest increase in home prices to be seen in:

Alberta, by 7 per cent to $479,765

British Columbia, by 6.9 per cent to $1,037,382

Nova Scotia, by 6.7 per cent to $451,114

Quebec, by 5.9 per cent to $515,877