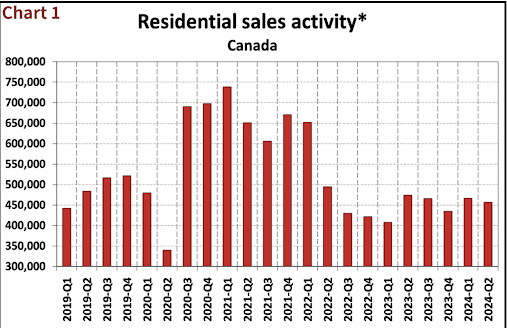

Canadian Real Estate is regaining momentum following a 3.7% rise in national home sales, driven by a strategic interest rate cut by the Bank of Canada.

Muted Rate Cut Forecasts Could Influence Buyer Decisions

- Expectations for interest rate cuts have been lowered due to a surge in properties.

- Low buyer activity and consumer sentiment persist.

- Gradual interest rate reduction expected to attract buyers.

- Sluggish spring market and rising supply have led to downward revisions in sales and average home price projections.

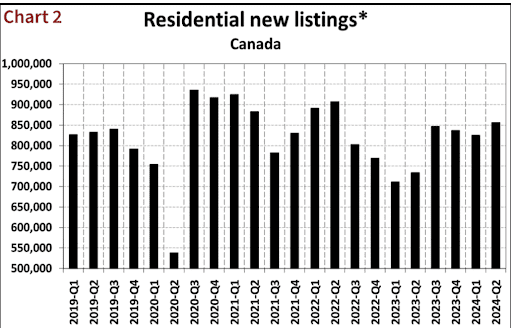

Listings Up 26% from Last June, Still Below Historical Average

- 472,395 properties expected to be sold, 6.1% increase from 2023.

- Total average home price projected to rise by 2.5% to $694,393.

- Home sales forecasted to increase by 6.2% to 501,902 units in 2025.

- National average home price expected to rise by 5% to $729,319.

- By June end, 180,000 properties listed, a 26% improvement from the previous year.

Inventory Buildup Slows, Signaling Balanced Market Conditions Ahead

- New listings increased by 1.5% month-over-month.

- MLS Home Price Index edged up by 0.1% from May 2024.

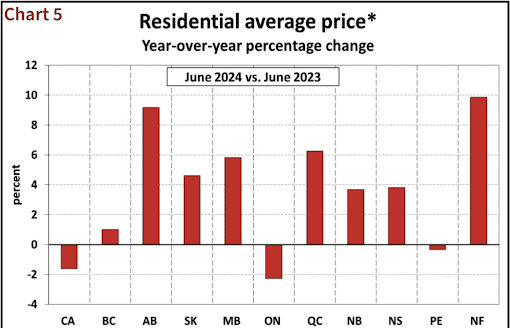

- HPI down 3.4% year-over-year.

- National average sale price decreased by 1.6% compared to June 2023.

- End-of-June property supply up by 26% but below historical average.

- National sales-to-new listings ratio improved to 53.9% in June, approaching long-term average.

Housing Prices Show Volatility

- Regional Housing Prices & Non-Seasonally Adjusted National Composite MLS HPI

- Calgary, Edmonton, Saskatoon, Montreal, and Quebec City’s prices have seen upward trajectory since early 2023.

- Ontario and Nova Scotia also saw recent price increases.

- Non-seasonally adjusted National Composite MLS HPI remains 3.4% below June 2023 levels.

- National average home price in June was $696,179, down 1.6% from the previous year.

Canada’s housing market is optimistic, with a projected 6.1% increase in sales this year and 2025.

However, future growth depends on overcoming challenges and managing supply-demand relationships.