Fine-Tuning will come into effect on April 26 for May 2024 and later expiries

The National Stock Exchange (NSE) has revised the lot size of 54 derivative contracts out of 182 stocksin fine-tuning. The change follows SEBI guidelines for periodic revision of lot sizes for derivatives contracts.

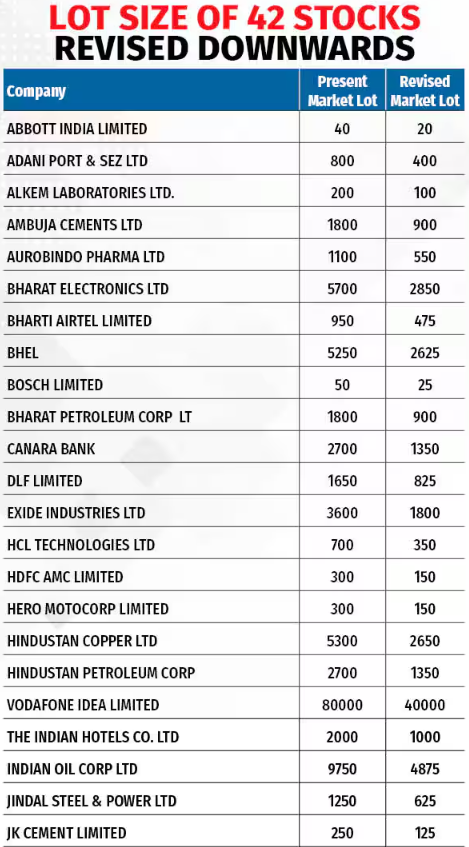

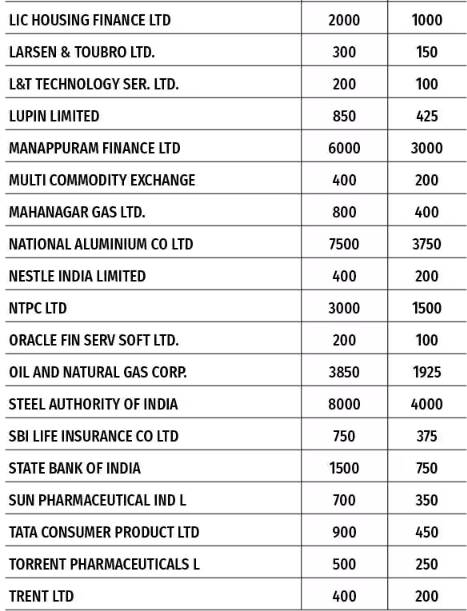

The derivative lot size of 42 stocks will be revised downwards, starting April 26 for May 2024 and later expiries. Notable stocks include Adani Ports, Bharti Airtel, BHEL, SBI, and L&T.

Lot Size of 42 stocks revised downwards

The derivative lot of 128 stocks, including Apollo Hospitals, Bajaj Finance, Asian Paints, and Adani Enterprises, remained unchanged.

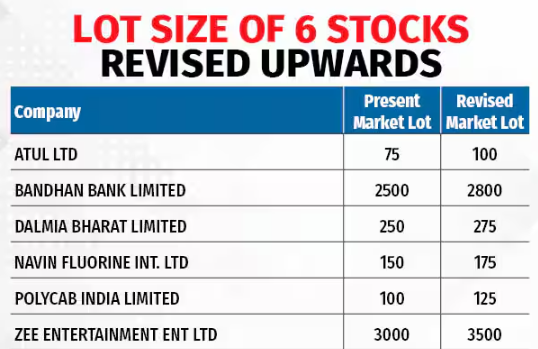

The NSE has revised the lot size of six stocks, Zee Entertainment, Polycab India, Navin Flourine, Dalmia Bharat, Bandhan Bank, and Atul, to increase their share in the derivative lot of 128 stocks, which will be effective from April 26 for July 2024 and later expiries.

The lot size for six stocks, Tata Motors, Bajaj Auto, Power Finance Corporation, Grasim Industries, Godrej Properties, and Tata Power, will be revised downwards and follow a new multiple starting from April 26 for July 2024.