Stock Analysis: Good Stocks to Buy Now for Long Term Under 100 – Roku Inc. (ROKU)

If you’re searching for good stocks to buy now for long term under 100, Roku Inc. (ROKU) is a strong contender. On Wednesday, 13 November 2024, Roku closed at $75.21, and the stock shows strong potential for growth into 2025. Let’s break down the technical analysis and why Roku Inc. is one of the good stocks to buy now for long term under 100.

1. Overview of Roku Inc. (ROKU)

Roku Inc. is a leading player in the streaming industry, offering streaming devices and a platform for users to access a wide range of content. As demand for streaming continues to grow, Roku is positioned well for long-term growth, making it one of the good stocks to buy now for long term under 100.

2. Closing Price: 13 November 2024

On 13 November 2024, Roku closed at $75.21. The stock is showing signs of recovery from a downtrend, and its current technical setup makes it an attractive option for long-term investors looking for good stocks to buy now for long term under 100.

3. Weekly Time Frame Analysis

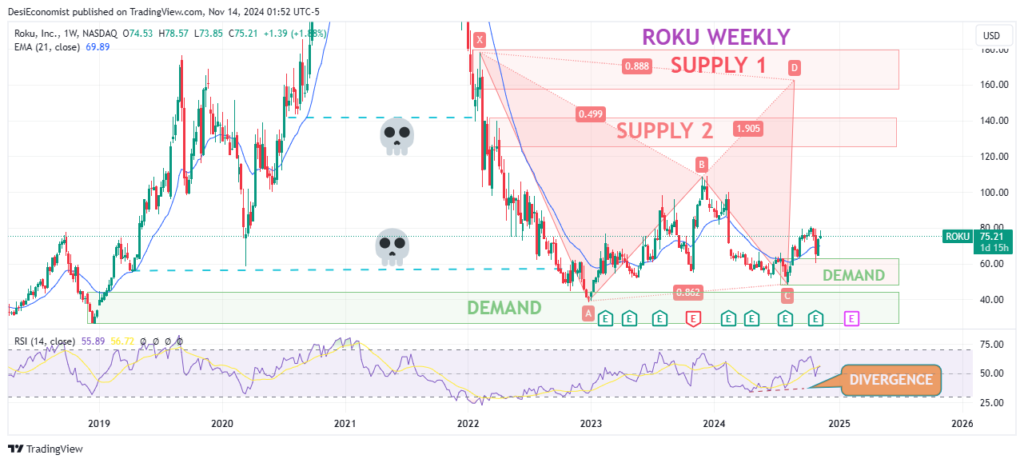

On the weekly time frame, Roku has been in a downtrend, forming lower lows (LL) and lower highs (LH) on the chart. In December 2022, the stock tested a key demand zone near its December 2018 swing low at $40. After reaching this level, the stock bounced and entered a buying trend, which has continued into 2024.

Currently, Roku is trading above the 21 EMA (Exponential Moving Average), signaling that the stock has gained momentum and may continue moving upward. The weekly chart also shows an incomplete bearish harmonic pattern near the $162 price level, indicating potential upside in the long term.

The RSI (Relative Strength Index) is showing bullish divergence, meaning that although the stock was in a downtrend, the momentum has shifted in favor of the bulls. These signals suggest that Roku is a strong candidate among good stocks to buy now for long term under 100.

4. Key Bullish Indicators

- Test of Key Support Level: Roku tested its December 2018 swing low of $40 in December 2022 and bounced, indicating strong buyer interest at that level.

- Bullish Harmonic Pattern: The incomplete bearish harmonic pattern near $162 suggests further upside as the stock continues its recovery.

- Break Above 21 EMA: The stock is trading above the 21 EMA, indicating a shift in momentum towards the bulls and signaling potential upward movement.

5. Supply Zones and Price Targets

Roku has three unmitigated supply zones to watch for potential resistance as the stock moves upwards:

- First supply zone at $100

- Second supply zone at $130

- Third supply zone at $160

These zones represent key price levels where the stock may encounter resistance, but they also offer targets for long-term investors looking for upside opportunities.

6. Critical Support Level: $48

While Roku is showing strong bullish signals, it’s important to monitor the $48 price level. If the stock breaks and closes below $48, the current bullish setup would be invalidated, and further downside could occur. However, as long as the stock remains above this level, the bullish outlook remains intact, making it one of the good stocks to buy now for long term under 100.

Buy Swing Trade Idea for Roku Inc. (ROKU)

For swing traders, Roku offers a favorable setup with solid risk-to-reward potential. Here’s a swing trade idea based on current technical analysis:

- Buy Entry Range: $57 – $53

- Stop Loss: $48

- Target 1: $100

- Target 2: $122

CHECKOUT HERE :- Next Good Swing Trade Stocks With Target & Stop Loss

This swing trade setup provides a strong risk-to-reward ratio, with the stop-loss set just below the critical $48 support level. The first target of $100 and the second target of $122 are realistic based on the stock’s historical price action and key resistance zones.

7. Why Roku is Among the Good Stocks to Buy Now for Long Term Under 100

Roku stands out as one of the good stocks to buy now for long term under 100 for several reasons:

- Test of Key Support Level: The stock successfully bounced off the $40 demand zone, indicating strong buyer interest.

- Bullish Harmonic Pattern: The incomplete harmonic pattern suggests there is room for the stock to grow toward $162.

- Break Above 21 EMA: Roku’s break above the 21 EMA shows a shift in momentum, with buyers driving the stock higher.

These factors make Roku a compelling option for both swing traders and long-term investors looking for good stocks to buy now for long term under 100.

8. Risk Management and Strategy

While Roku presents a strong bullish setup, proper risk management is essential. Swing traders should adhere to the stop-loss at $48 to protect against downside risk if the stock breaks below this critical support level.

For long-term investors, monitoring broader market trends in the streaming and digital media industries, as well as Roku’s financial performance, will help guide investment decisions. As the stock approaches its upside targets of $100 and $122, adjusting positions or taking partial profits may be a prudent strategy to lock in gains while managing risk.

9. Long-Term Investment Outlook

Roku operates in a rapidly growing industry, providing streaming solutions that are becoming increasingly popular as more consumers cut the cord and turn to digital content. As the streaming market continues to expand, Roku is well-positioned for long-term growth. For investors seeking good stocks to buy now for long term under 100, Roku offers both value and significant upside potential.

With upside targets of $100 and $122, there is substantial room for price appreciation in the coming months and years. Long-term investors can benefit from Roku’s strong position in the streaming industry and its ability to capture market share.

10. Conclusion: Roku is a Strong Buy for Long-Term Investors

Roku Inc. (ROKU) is one of the good stocks to buy now for long term under 100 due to its bullish technical setup, strong demand zone support, and potential for continued growth in the streaming industry. With upside targets of $100 and $122, the stock presents a promising opportunity for both swing traders and long-term investors.

As long as the stock holds above the $48 level, the bullish outlook remains valid, and Roku could continue to rise in the coming weeks and months. For those seeking a combination of short-term gains and long-term growth, Roku is a top contender among the good stocks to buy now for long term under 100.

FAQs

1. Is Roku a good stock to buy for long-term investment?

Yes, Roku is considered one of the good stocks to buy now for long term under 100 due to its strong technical setup, recovery from key support levels, and long-term growth potential in the streaming industry.

2. What is the closing price of Roku on 13 November 2024?

On 13 November 2024, Roku closed at $75.21.

3. What are the upside targets for Roku?

The upside targets for Roku are $100 and $122, with potential resistance at these levels.

Read More Information About US Stock Market

Note: Always remember: risk no more than 1% per trade.” Keep trailing your stop loss to secure bigger profits.

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join Free our Discord community , Join Our Whatsapp Group

Our Articles on Long-Term Stock Analysis My best read on trading is this Book All Swing Trades Idea’s Here