Stock Analysis: Good Stocks to Buy Now for Long Term Under 50 – Warner Bros Discovery (WBD)

If you’re looking for good stocks to buy now for long term under 50, Warner Bros Discovery (WBD) presents a solid opportunity. On Friday, 8 November 2024, Warner Bros Discovery closed at $9.18, making it an attractive stock for long-term investors in 2025. Let’s explore the technical analysis and why Warner Bros Discovery stands out as one of the good stocks to buy now for long term under 50.

1. Overview of Warner Bros Discovery (WBD)

Warner Bros Discovery is a major media and entertainment conglomerate, producing and distributing content across television, film, and digital platforms. With its rich library of intellectual properties and content, WBD is positioned for growth in the entertainment industry, making it one of the good stocks to buy now for long term under 50.

2. Closing Price: 8 November 2024

On 8 November 2024, Warner Bros Discovery closed at $9.18. The stock has been showing signs of a bullish reversal, and its current price level suggests potential upside in the near term, positioning it as a great pick for long-term investors seeking good stocks to buy now for long term under 50.

3. Weekly Time Frame Analysis

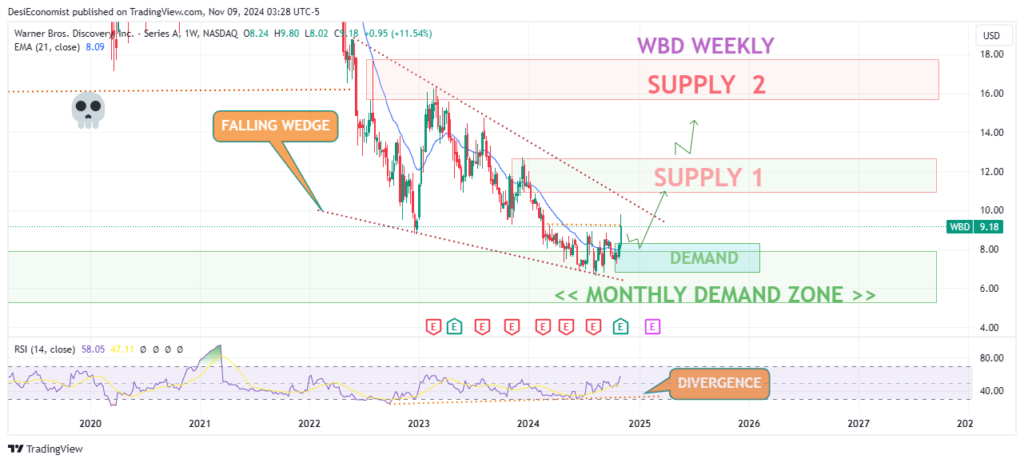

Looking at the weekly time frame, Warner Bros Discovery has been trading within a falling wedge pattern, which is typically a bullish reversal pattern. The stock tested its all-time swing low from 2008 in August 2024, reaching around $6 at a key demand zone. Since then, the stock has broken above the 21 EMA (Exponential Moving Average), signaling that a potential upward movement may be underway.

The RSI (Relative Strength Index) on the weekly chart is also showing bullish divergence, indicating that while the stock price was declining, momentum was building in favor of the bulls. This suggests that Warner Bros Discovery is one of the good stocks to buy now for long term under 50 as it begins to reverse its downward trend.

4. Daily Time Frame: Bullish Signals and High Volume

On the daily time frame, Warner Bros Discovery is showing further bullish signs. The stock has experienced ultra-high volume near the daily resistance level, which is a strong indication that buyers are stepping in. Additionally, the stock has shifted from a bearish trend to a bullish trend, confirming that momentum has changed.

As the stock continues to trade above its key moving averages and shows strong volume near resistance levels, it is expected to bounce towards the upside in the coming weeks, making it one of the good stocks to buy now for long term under 50.

5. Critical Support Level: $6.50

While Warner Bros Discovery is showing bullish signals, it’s important to monitor the $6.50 price level. If the stock breaks and closes below $6.50, the current bullish setup would be invalidated, and further downside could be expected. However, as long as the stock holds above this critical level, the bullish outlook remains intact.

Buy Swing Trade Idea for Warner Bros Discovery (WBD)

For swing traders, Warner Bros Discovery offers a favorable trading setup with solid risk-to-reward potential. Here’s a swing trade idea based on current technical analysis:

- Buy Entry Range: $8.70 – $7

- Stop Loss: $6.50

- Target 1: $9.80

- Target 2: $11.80

CHECKOUT HERE :- Next Good Swing Trade Stocks With Target & Stop Loss

This swing trade setup provides a strong risk-to-reward ratio, with the stop-loss set just below the critical $6.50 support level. The first target of $9.80 and the second target of $11.80 are realistic based on the stock’s historical price action and key resistance zones.

6. Why Warner Bros Discovery is Among the Best Stocks to Buy Now for Long Term Under 50

Warner Bros Discovery stands out as one of the good stocks to buy now for long term under 50 for several reasons:

- Falling Wedge Pattern: The stock is trading within a falling wedge, a bullish reversal pattern that signals potential upside.

- Bullish Break Above 21 EMA: The stock has broken above the 21 EMA, indicating a shift in momentum.

- Bullish Divergence: The RSI on the weekly chart shows bullish divergence, suggesting that momentum is building in favor of the bulls.

- Ultra-High Volume: The stock has seen high volume near key resistance levels, confirming strong buying interest.

These factors make Warner Bros Discovery a compelling option for both swing traders and long-term investors looking for good stocks to buy now for long term under 50.

7. Risk Management and Strategy

While Warner Bros Discovery presents a strong bullish setup, proper risk management is essential. Swing traders should adhere to the stop-loss at $6.50 to protect against downside risk if the stock breaks below this key support level.

For long-term investors, it’s important to monitor broader market trends in the entertainment industry and Warner Bros Discovery’s performance as it executes its business strategy. As the stock approaches its upside targets of $9.80 and $11.80, adjusting positions or taking partial profits may be a wise strategy to lock in gains while managing risk.

8. Long-Term Investment Outlook

Warner Bros Discovery is a major player in the global media and entertainment industry, with a vast portfolio of content that positions it well for long-term growth. As the demand for streaming services, content creation, and digital media continues to rise, Warner Bros Discovery is well-positioned to benefit from these trends. For investors seeking good stocks to buy now for long term under 50, WBD offers both value and significant upside potential.

With upside targets of $9.80 and $11.80, there is substantial room for price appreciation in the coming months and years. Long-term investors can benefit from Warner Bros Discovery’s strong market position and its ability to generate growth through its diverse content offerings.

9. Conclusion: Warner Bros Discovery is a Strong Buy for Long-Term Investors

Warner Bros Discovery (WBD) is one of the good stocks to buy now for long term under 50 due to its bullish technical setup, strong demand zone support, and bullish divergence on the weekly chart. With upside targets of $9.80 and $11.80, the stock presents a promising opportunity for both swing traders and long-term investors.

As long as the stock holds above the $6.50 level, the bullish outlook remains valid, and Warner Bros Discovery could continue to rise in the coming weeks and months. For those seeking a combination of short-term gains and long-term growth, WBD is a top contender among the good stocks to buy now for long term under 50.

FAQs

1. Is Warner Bros Discovery a good stock to buy for long-term investment?

Yes, Warner Bros Discovery is considered one of the good stocks to buy now for long term under 50 due to its strong technical setup, bullish reversal pattern, and long-term growth potential in the entertainment industry.

2. What is the closing price of Warner Bros Discovery on 8 November 2024?

On 8 November 2024, Warner Bros Discovery closed at $9.18.

3. What are the upside targets for Warner Bros Discovery?

The upside targets for Warner Bros Discovery are $9.80 and $11.80, with potential resistance at these levels.

Read More Information About US Stock Market

Note: Always remember: risk no more than 1% per trade.” Keep trailing your stop loss to secure bigger profits.

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join Free our Discord community , Join Our Whatsapp Group

Our Articles on Long-Term Stock Analysis My best read on trading is this Book All Swing Trades Idea’s Here