Company Overview:

- Palomar Holdings, Inc. is a specialized insurance provider operating in the United States, catering to both residential and commercial clients.

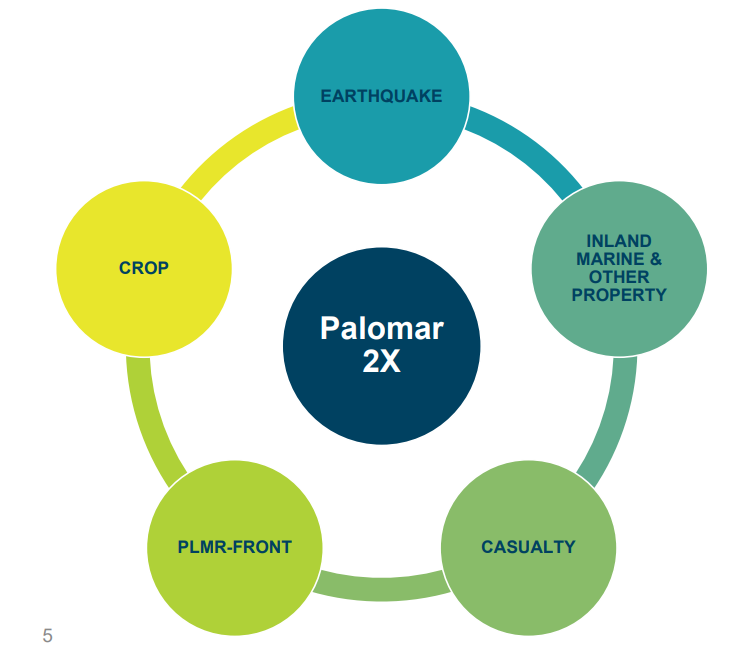

- Its range of insurance products covers various aspects of property and casualty, including earthquake, fronting, commercial all risk, specialty homeowners, inland marine, Hawaii hurricane, and residential flood insurance.

- The company also engages in assumed reinsurance, extending its services beyond direct insurance offerings.

- Established in 2013 and headquartered in La Jolla, California, the company was previously known as GC Palomar Holdings before rebranding to its current name.

- These are the main five categories in which the company operates its business.

Why Palomar (PLMR) appears to be a Sound Investment :

- The company’s robust net margin stands at approximately 21.78%.

- The company provided positive guidance for 2024, anticipating an increase in Adjusted Net Income to a range of $110 to $115 million.

- The company aims to use a natural approach to double underwriting income and maintain a Return on Equity (ROE) over 20% in the near future.

- The company boasts a healthy free cash flow per share of $4.41.

- Palomar stands out as one of the selected 13 insurance providers authorized by the federal government. It grants entry into the lucrative $20 billion annual Crop insurance market.

- The company’s Return on Capital (ROIC) stands at 16.70%.

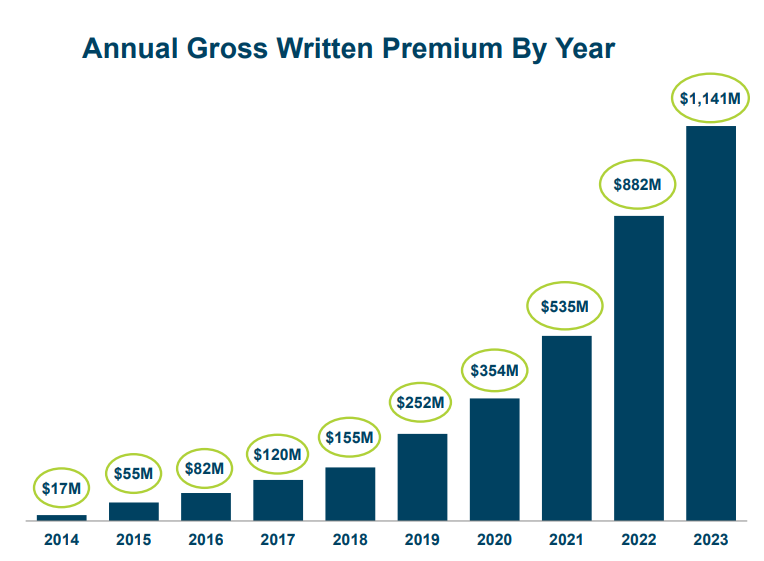

- The annual gross premium written by the company shows a consistent year-over-year increase.

Risk Factors:

- Unforeseeable and severe catastrophe events, including those related to global climate change, could drastically reduce our earnings, stockholders’ equity, and ability to underwrite new insurance policies.

- With a P/E ratio of 24.27 and an EV/EBIT ratio of 17.62, the company’s valuation appears relatively high.

Chart:

= The current price of the stock is up by 69% compared to its value one year ago.

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join our Discord community.

Our Articles on Long-Term Stock Analysis My best read on trading is this Book