In this article, I will explore How does Inflation Impact the Common man life and what steps can be taken to protect oneself from its negative impact.

Inflation and recession are two economic phenomena that significantly impact people’s lives. During the annual World Economic Forum summit in Davos last month, global leaders were presented with a disheartening economic outlook.

According to the Chief Economists Outlook report by the WEF, two-thirds of polled economists predicted a global recession – a contraction in the world’s gross domestic product – to be likely in 2023. In addition, the World Bank cautioned in January that the global economy was at a precarious risk of slipping into a recession.

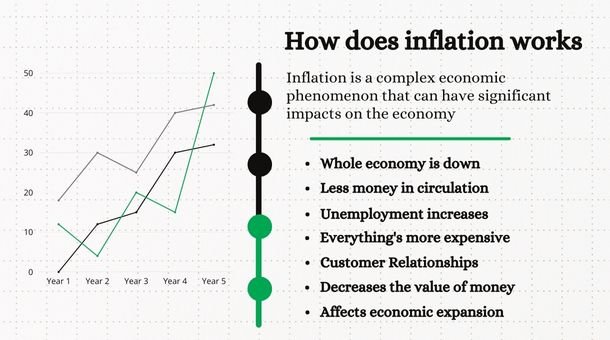

Understanding Inflation: How It Works and Its Impact on the Economy

Inflation is a complex economic phenomenon that can have significant impacts on the economy and society as a whole. Here’s a breakdown of how Inflation works and the impacts it can have.

The whole economy is down:

A weak economy with low growth rates can contribute to Inflation. When economic activity slows down, there is less demand for goods and services. However, the supply of goods and services remains the same, which can lead to higher prices.

Less money in circulation:

If there is less circulation, businesses and individuals may be less willing or able to spend money. This can lead to lower demand for goods and services, which can cause prices to decrease. However, if the supply of goods and services remains constant, prices may stay the same or even increase.

Unemployment increases:

When the unemployment rate rises, individuals tend to have reduced purchasing power. Consequently, the demand for goods and services will likely decrease, which could result in a price drop. However, if the supply of goods and services remains unchanged, the prices may remain stable or even rise.

Everything’s more expensive:

Inflation causes prices to increase over time, making everything more expensive. This can significantly impact people’s purchasing power, as they may need help to afford the same goods and services they used to.

Price increases impact Customer Relationships:

When prices increase, customers may feel frustrated or angry. This can impact their relationship with businesses, as they may feel they are being taken advantage of. This can have long-term impacts on customer loyalty and sales.

Decreases the value of money:

Inflation is a phenomenon where the value of money depreciates over time, reducing the purchasing power of a fixed amount of money. As a result, the same amount of money can purchase fewer goods and services than it could previously. This can notably impact people’s savings, retirement funds, and other investments.

Affects economic expansion:

Inflation can have a significant impact on economic growth. High inflation rates can decrease consumer spending and investment, slowing economic growth. Conversely, low inflation rates stimulate economic growth by encouraging spending and investment.

How does Inflation affect different sectors?

As we look forward to 2023, Inflation is a persistent increase in the general price level of goods and services over time, reducing the purchasing power of money. This phenomenon can profoundly impact the economy as a whole and different sectors. Here, I will explore how Inflation affects different sectors.

Real Estate

Inflation can profoundly affect the real estate market, particularly when inflation rates are high. High Inflation can result in an upsurge in interest rates, thereby increasing the cost of borrowing funds. This can lead to a decline in the demand for real estate, as prospective buyers may need more financial capacity to afford higher mortgage payments.

Furthermore, inflationary pressures can increase the costs of building materials and labor, subsequently increasing the cost of constructing new properties. This can result in a decline in the supply of new housing units, further exacerbating the challenges in the real estate market.

Service Costs Increase

Inflation can increase the cost of goods and services from basic needs like food and fuel to luxury items like hotels and travel.

This can significantly impact the service industry, as businesses may need help maintaining profitability while facing increased costs. In turn, consumers may experience decreased purchasing power and reduced access to essential goods and services.

Effect on the labor market

Inflation can affect the labor market in several ways. Rising prices can lead to an increase in the cost of living, which can put pressure on workers to demand higher wages.

If businesses cannot pay higher wages, they may need to reduce their workforce, leading to unemployment. Alternatively, businesses may increase prices to maintain profitability, reducing demand and leading to further unemployment.

Stock market to drop

Inflation can also have a significant impact on the stock market. As Inflation rises, investors may become concerned about companies’ future profitability, leading to a drop in stock prices. Additionally, high Inflation can lead to an increase in interest rates, making bonds more attractive to investors and reducing demand for stocks.

Loans become much tougher to get

Loans Become Tougher to Get When Inflation is high, banks may become more cautious about lending money, as they are concerned about the borrower’s ability to repay the loan in the future. As a result, it may become more challenging for individuals and businesses to get loans, reducing their ability to invest in projects or purchase assets.

Top 7 Effective Methods to Control Inflation in Your Business

The peak of this current inflationary period was recorded in June 2022, with the year-over-year Consumer Price Index (CPI) hitting 9.1%, the highest in four decades.

The year-over-year inflation rate, which had risen to an alarming level, has declined from its peak in November 2021. However, the latest figures from January 2023 reveal that the rate is still higher than the target set by policymakers, currently standing at 6.4 percent. While the Federal Reserve is responsible for implementing monetary policy to control Inflation, could fiscal policy also be a supplementary tool?

Here, I will explore various methods to control Inflation.

Interest Rate Rises

Increasing interest rates is one of the most effective methods to control Inflation. Higher interest rates make borrowing more expensive, reducing the amount of money in circulation and decreasing demand for goods and services. This can lead to decreased Inflation as businesses and consumers reduce their spending.

Money Supply Control Central banks

It can also control Inflation by regulating the money supply. Central banks can reduce Inflation by decreasing the amount of money in circulation. Central banks can use tools like open market operations, reserve requirements, and discount rates to control the money supply.

Higher Taxes

Raising taxes is another potential approach to managing Inflation. By increasing taxes, governments can reduce the amount of money in circulation, decreasing demand for goods and services. This could lead to a decline in Inflation.

Supply-side policies for economic boost

Supply-side policies focus on increasing the supply of goods and services in the economy, which can decrease Inflation. Examples of supply-side policies include reducing regulatory burdens, increasing productivity, and investing in infrastructure.

Regulates the money supply

Regulating the money supply can also help control Inflation. This involves implementing policies that regulate the amount of money in circulation, such as adjusting interest rates or implementing reserve requirements for banks.

New Currency Issuance

There are instances where governments resort to issuing new currency to curb Inflation. This strategy involves substituting old currency with a new currency with a smaller denomination, which can reduce the amount of money in circulation. Ultimately, this could aid in decreasing Inflation.

Demonetization

Demonetization involves removing the status of legal tender from certain banknotes or coins. This method can help control Inflation by removing a significant amount of money from circulation.

How to save yourself from Inflation?

Inflation can significantly impact our daily lives, and it’s important to be prepared for it. Here are some steps to protect yourself from the negative effects of Inflation in 2023.

Invest in high-yielding assets

Investing in high-yielding assets is an effective way to shield oneself from Inflation. Such assets can include real estate, bonds, and stocks, which provide a consistent income stream and the potential for capital appreciation. By doing so, one can offset the impact of Inflation on their wealth.

Spend less on unnecessary things

In times of Inflation, it is crucial to be prudent with one’s spending habits. An effective approach is to reduce expenses that are deemed unnecessary, such as dining out less frequently, purchasing fewer luxury items, and seeking discounts when buying essentials such as groceries and household supplies. By doing so, one can better manage their finances during rising prices.

Reassess your budget

Inflation can cause prices to rise across the board, impacting your budget. It’s important to reassess your budget regularly to ensure you’re still on track. This may mean cutting back on certain expenses or increasing your income.

Prepare an emergency fund

The impact of Inflation can be daunting, particularly if one faces an abrupt loss of income. Building an emergency fund is a prudent step to brace for unforeseen expenses or income disruptions. Financial experts recommend having enough savings to cover at least three months of living expenses. This will provide a financial cushion and help mitigate the impact of Inflation on one’s finances.

Pay off high-interest liabilities

Inflation can also affect the cost of borrowing funds. If one has high-interest debt, such as credit card debt or a high-interest loan, it is crucial to prioritize paying it off. Doing so can result in long-term savings and help to reduce one’s overall debt burden.

Enhance your job chances in alternative ways

In times of Inflation, staying competitive in the job market is important. This may mean investing in additional education or training, developing new skills, or seeking out opportunities for career advancement.

Maintain your investments

During times of Inflation, it’s important to stay invested in the market to ensure that your money continues to grow. However, it’s also important to be mindful of your investments and make adjustments as necessary. This may mean rebalancing your portfolio or diversifying your investments to reduce risk.

Looking for budget buys for daily life use

Inflation can cause prices to rise on many everyday items, but there are still opportunities to save money. This can include shopping for deals on essentials like groceries and household supplies or buying used items instead of new ones.

Conclusion

Inflation can significantly impact individuals’ lives, as seen during the years 2020-2023. The steady price increase during this period made it difficult for people to afford essential goods and services, leading to a declining standard of living. The value of savings and retirement funds also decreased, impacting individuals’ financial stability.

The cost of borrowing money also increased, making it more challenging for individuals to take out loans or pay off high-interest debt. To combat the effects of Inflation during this time, people had to make adjustments such as cutting back on expenses, seeking higher-yielding investments, and building emergency funds. It is crucial to remain vigilant about Inflation and its impact on personal finances to stay financially stable and secure during rising prices.

How does Inflation Impact the Common man life How does Inflation Impact the Common man life How does Inflation Impact the Common man life How does Inflation Impact the Common man life How does Inflation Impact the Common man life How does Inflation Impact the Common man life How does Inflation Impact the Common man life How does Inflation Impact the Common man life