Raging Sell-off

Smallcap equities have performed admirably over the last year, outperforming largecaps by a wide margin. From April 1, 2023 to February 19, 2024, the BSE Sensex gained around 24%, compared to 71% for the BSE Smallcap.

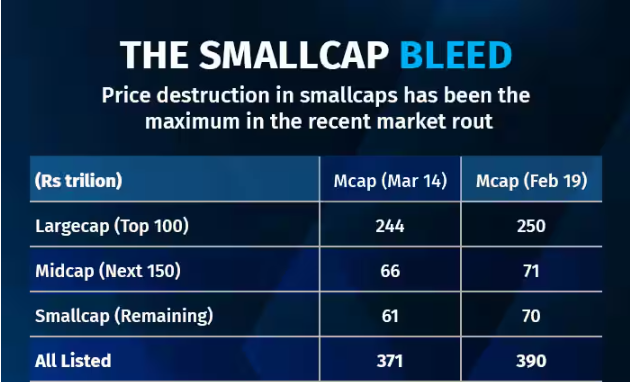

The stock market has experienced a significant drop in value since February 19, with smallcap stocks being hit the hardest. Over Rs 9 trillion in investor wealth has been lost due to this market correction, accounting for more than 50% of the total value destruction. However, smallcaps have recovered on March 14, with the BSE Smallcap index gaining over 3% after losing 12% since February 19.

Smallcap stocks have had a remarkable run over the past year, outpacing largecaps by a wide margin. Factors contributing to smallcaps’ correction include ED raids on a big market operator and allied entities, Sebi flagging ‘froth’ in the market, and a liquidity stress test spreading fears of unwinding by mutual funds. Market participants have also become concerned that the RBI may attempt to thwart money flowing into the stock market.

Biggest smallcap losers

Between February 19 and March 14, 16 BSE Smallcap index stocks lost 40-56% of their gains from 52-week highs. Ramky Infrastructure experienced the largest loss, losing 56% after gaining 65% in the last year. Andrew Yule & Company and IFCI also experienced a 47% erosion from their recent 52-week highs.

Approximately 83 stocks posted 30-40% losses from 52-week highs, while 161 stocks posted 20-30% losses. HLV Ltd, Orient Green Power, Balu Forge Industries, Paisalo Digital, Sandur Manganese & Iron Ores, Salasar Techno Engineering, Sangam India, Sigachi Industries, Prakash Industries, Visaka Industries, India Pesticides, Indo Amines, and Speciality Restaurants were among the affected stocks.

Is the Market Turmoil as Bad as It Seems, or Are Further Challenges Ahead?

The BSE Smallcap Index has seen a significant fall, with a 10% decline in the past month but still up 54% over the past year. Despite this, 63% of small-cap stocks have provided returns exceeding 30% in the past year, despite most experiencing negative returns in the past month.

Harsha Upadhyaya, CIO-Equity at Kotak AMC, stated that despite the market correction in midcap and smallcap, Kotak Mahindra AMC has not deployed all its available cash, with pockets with excesses building up witnessing the most correction.

Kotak Institutional Equities is uncertain about changes in non-institutional investors’ behavior, despite recent corrections and regulatory warnings. They believe high return expectations and past gains may have reinforced participation in mid- and small-cap stocks, with domestic institutional investors’ funds becoming conduits for active non-institutional investors.

Must read book about investing – check here Raging Sell-off Raging Sell-off Raging Sell-off Raging Sell-off Raging Sell-off Raging Sell-off Raging Sell-off

The stock market has experienced a significant drop in value since February 19, with smallcap stocks being hit the hardest. Over Rs 9 trillion in investor wealth has been lost due to this market correction, accounting for more than 50% of the total value destruction. However, smallcaps have recovered on March 14, with the BSE Smallcap index gaining over 3% after losing 12% since February 19.

Smallcap stocks have had a remarkable run over the past year, outpacing largecaps by a wide margin. Factors contributing to smallcaps’ correction include ED raids on a big market operator and allied entities, Sebi flagging ‘froth’ in the market, and a liquidity stress test spreading fears of unwinding by mutual funds. Market participants have also become concerned that the RBI may attempt to thwart money flowing into the stock market.

Smallcap stocks have had a remarkable run over the past year, outpacing largecaps by a wide margin. Factors contributing to smallcaps’ correction include ED raids on a big market operator and allied entities, Sebi flagging ‘froth’ in the market, and a liquidity stress test spreading fears of unwinding by mutual funds. Market participants have also become concerned that the RBI may attempt to thwart money flowing into the stock market.