Stock Analysis: Today Best Share to Buy for Long Term in 2025 – Global Payments Inc. (GPN)

If you’re searching for the today best share to buy for long term in 2025, Global Payments Inc. (GPN) is an excellent candidate. On Friday, 8 November 2024, Global Payments closed at $110.88, positioning it as a top choice for long-term investors in the payments sector. Let’s explore the technical analysis and why Global Payments Inc. is one of the today best share to buy for long term in 2025.

1. Overview of Global Payments Inc. (GPN)

Global Payments is a worldwide provider of payment technology and software solutions, offering businesses the ability to process payments efficiently. As digital payments continue to grow, GPN is positioned to capitalize on this trend, making it one of the today best share to buy for long term in 2025.

2. Closing Price: 8 November 2024

On 8 November 2024, Global Payments closed at $110.88, which shows that the stock has recently rebounded from key support levels. The technical indicators suggest further upside potential, making it a strong pick for investors seeking today best share to buy for long term in 2025.

3. Weekly Time Frame Analysis

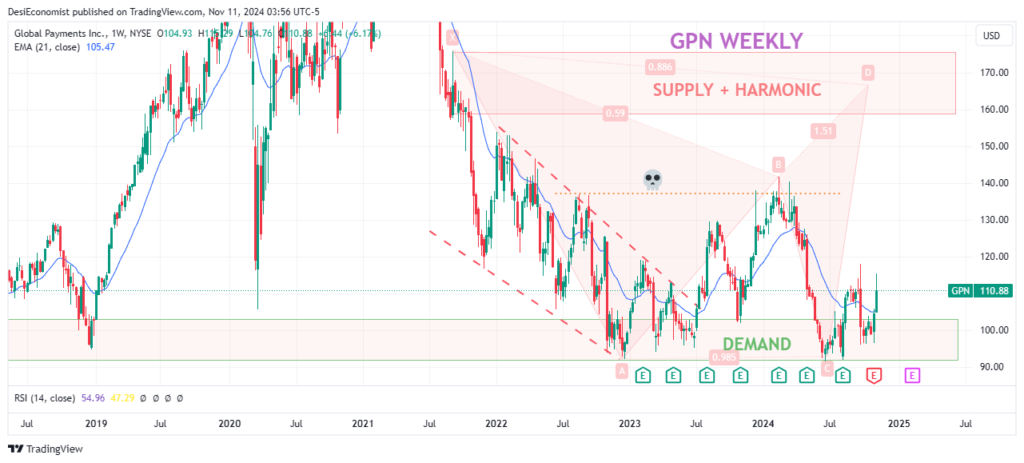

Looking at the weekly time frame, Global Payments has repeatedly found support around the $91-$95 price level, indicating that this area acts as a strong demand zone. In June 2024, the stock tested this demand zone and bounced upwards, showing that buyers are stepping in at these price levels.

The stock is currently trading above the 21 EMA (Exponential Moving Average), indicating that the stock is gaining momentum and could continue to rise in the coming weeks. Additionally, an incomplete bearish harmonic pattern near the $166 price level suggests that the stock has more upside potential, reinforcing that Global Payments is one of the today best share to buy for long term in 2025.

4. Key Bullish Indicators

- Demand Zone Support: The stock has held strong at the $91-$95 price level, which has proven to be a reliable support area.

- Bullish Harmonic Pattern: The incomplete bearish harmonic pattern near $166 indicates a potential long-term price target as the stock continues its bullish trajectory.

- Break Above 21 EMA: The stock has broken above the 21 EMA, a key indicator of upward momentum, signaling the possibility of further gains.

5. Critical Support Level: $91

While Global Payments is showing strong bullish signals, it’s important to keep an eye on the $91 price level. If the stock breaks and closes below $91, the current bullish setup would be invalidated, and further downside could be expected. However, as long as the stock remains above this level, the bullish outlook is likely to continue.

Buy Swing Trade Idea for Global Payments Inc. (GPN)

For swing traders looking for short-term opportunities, Global Payments offers a well-defined setup with solid risk-to-reward potential. Here’s a swing trade idea based on current technical analysis:

- Buy Entry Range: $105 – $95

- Stop Loss: $91

- Target 1: $133

- Target 2: $145

This swing trade setup provides a favorable risk-to-reward ratio, with the stop-loss set just below the critical $91 support level. The first target of $133 and the second target of $145 are realistic based on the stock’s historical price action and key resistance levels.

CHECKOUT HERE :- Next Good Swing Trade Stocks With Target & Stop Loss

6. Why Global Payments is Among the Best Shares to Buy for Long Term in 2025

Global Payments stands out as one of the today best share to buy for long term in 2025 for several reasons:

- Strong Demand Zone: The stock has consistently bounced off the $91-$95 demand zone, indicating strong buyer interest at these levels.

- Bullish Momentum: The stock is trading above its 21 EMA, suggesting sustained upward momentum.

- Harmonic Pattern: The incomplete bearish harmonic pattern near $166 indicates further upside potential for long-term investors.

These factors make Global Payments a compelling option for both swing traders and long-term investors looking for today best share to buy for long term in 2025.

7. Risk Management and Strategy

While Global Payments presents a strong bullish setup, proper risk management is crucial. Swing traders should adhere to the stop-loss at $91 to protect against downside risk if the stock breaks below the key support level.

For long-term investors, monitoring broader market trends in the payment processing industry and Global Payments’ performance will help guide investment decisions. As the stock approaches its upside targets of $133 and $145, adjusting positions or taking partial profits may help lock in gains while managing risk.

8. Long-Term Investment Outlook

Global Payments is a leader in the digital payments industry, providing essential technology solutions that allow businesses to process payments efficiently. As the global economy continues to shift towards digital transactions, Global Payments is well-positioned to benefit from these trends. For investors seeking today best share to buy for long term in 2025, Global Payments offers both value and growth potential.

With upside targets of $133 and $145, there is substantial room for price appreciation in the coming months and years. Long-term investors can benefit from Global Payments’ strong market position and its ability to capitalize on the growing demand for digital payments.

9. Conclusion: Global Payments is a Strong Buy for Long-Term Investors

Global Payments Inc. (GPN) is one of the today best share to buy for long term in 2025 due to its solid technical setup, strong demand zone support, and bullish momentum. With upside targets of $133 and $145, the stock presents a promising opportunity for both swing traders and long-term investors.

As long as the stock holds above the $91 level, the bullish outlook remains valid, and Global Payments could continue to rise in the coming weeks and months. For those seeking a combination of short-term gains and long-term growth, Global Payments is a top contender among the today best share to buy for long term in 2025.

FAQs

1. Is Global Payments a good stock to buy for long-term investment?

Yes, Global Payments is considered one of the today best share to buy for long term in 2025 due to its strong technical setup, reliable demand zone support, and long-term growth potential in the digital payments industry.

2. What is the closing price of Global Payments on 8 November 2024?

On 8 November 2024, Global Payments closed at $110.88.

3. What are the upside targets for Global Payments?

The upside targets for Global Payments are $133 and $145, with potential resistance at these levels.

Read More Information About US Stock Market

Note: Always remember: risk no more than 1% per trade.” Keep trailing your stop loss to secure bigger profits.

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join Free our Discord community , Join Our Whatsapp Group

Our Articles on Long-Term Stock Analysis My best read on trading is this Book All Swing Trades Idea’s Here