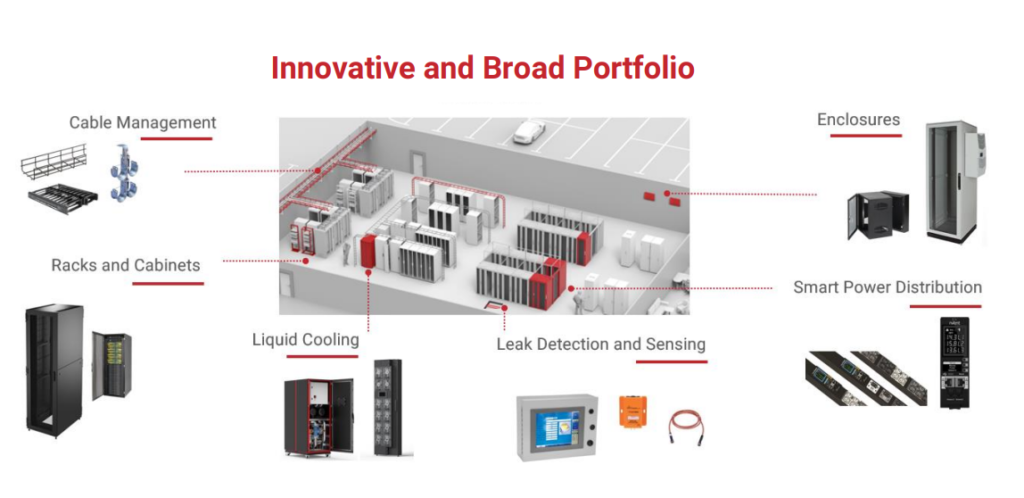

Company Overview:

- nVent Electric plc (NVT) and its subsidiaries are involved in the design, production, marketing, installation, and maintenance of electrical connection and protection solutions.

- The company operates in North America, Europe, the Middle East, Africa, the Asia Pacific, and globally.

- nVent Electric plc’s business is divided into three segments: Enclosures, Electrical & Fastening Solutions, and Thermal Management.

NVT seems like a solid investment:

- The company’s robust net margin stands at approximately 17.02%.

- Return on Capital (ROIC) at 13.88% and Return on Equity (ROE) at 19% are indeed exceptional, reflecting the company’s efficient use of capital and strong profitability.

- The company is active in the liquid cooling segment, which is anticipated to grow three times faster than traditional cooling methods.

- The company maintains strong financials, with a current ratio of 1.99 and a Debt/Equity ratio of 0.55.

- Additionally, the company expects full-year capital expenditures (capex) to range between $85 million to $90 million in 2024, while still maintaining positive cash flow

- In 2024, the company projects a sales increase of 8 to 10%, with Q2 2024 sales expected to rise by 10% to 12%.

- Distributed $32 million to shareholders in Q1, alongside a recent 9% increase in the quarterly dividend, underscoring dedication to returning value to investors.

- The company approved a plan to buy back up to $500 million of its own shares over three years. This will start on July 23, when the current buyback plan ends.

Risk Factors:

- The risk factor lies in the possibility of not meeting market expectations, which could lead to a significant correction, particularly as it’s considered a growth stock

- With a P/FCF ratio of 27.31 and an EV/EBIT ratio of 24.13, the company’s valuation appears relatively high.

Chart:

= The stock has a lot of momentum, with an impressive 85.98% increase over the past year.

Please note this is only an opinion and not financial advice.

NVT

To get regular updates on stocks, please join our Discord community.

Our Articles on Long-Term Stock Analysis My best read on trading is this Book