Please note this is only an opinion and not financial advice. Direct stock investing is subject to business and market risks. Therefore, it’s highly recommended to do proper risk management and your own due diligence before investing.

As of 10 April 2023

Zoetis Inc NYSE: ZTS

- Zoetis is a global animal health company that focuses on the development, manufacture, and sale of veterinary medicines and vaccines. The company’s business model can be summarized as follows:

- Research and Development: Zoetis invests heavily in research and development to develop new veterinary products and improve existing ones.

- Sales and Marketing: Zoetis sells its products through a network of distributors, veterinarians, and dealers.

- Strategic Acquisitions: Zoetis has a history of strategic acquisitions to expand its product portfolio and enter new markets.

What we think are pros of business:

- Diversification

- Strong R&D Capabilities

- Geographic Reach: Zoetis has a global presence, with operations in over 100 countries.

- Strategic Acquisitions

- Digital Solutions: Zoetis has been investing in digital solutions, which has helped the company improve animal health outcomes, increase productivity, and reduce costs.

What we think the risks are:

- Regulatory Risks

- Competition

- Economic Risks

- Intellectual Property Risks: Zoetis relies on patents and other intellectual property rights to protect its products and technologies.

- Product Liability

Fundamentals:

- Market Cap: $78 Billion

- P/E : 37

- D/E : 0.7

- Operating Cash Flow: $1,800 Million

- Profit margins = 38%

- ROE= 46.17%

- P/FCF= 59.0

Dividend Growth in past decade

Company has proved to be a strong dividend growth provider. This shows the strength of operations and management.

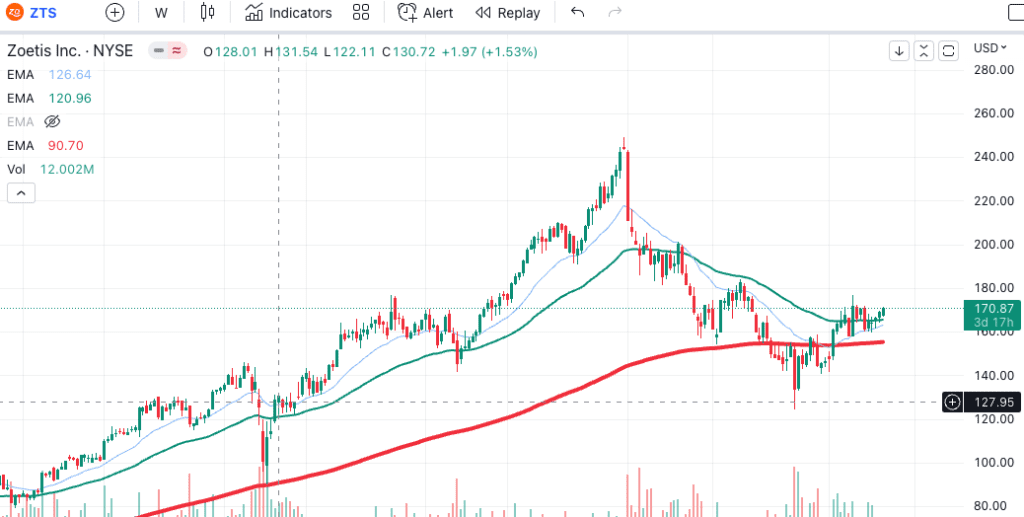

Technical for long term perspective:

Trend : Up for short term and sideways for midterms

Entry : 170 and DCA around 140

Target: 220

Our Final Thought:

Zoetis is a world leader in the animal care industry and is definitely a compounder. The stock trades at a premium because of this but you can accumulate at lower levels by checking technical analysis combined with fundamentals. You can also buy this for consistent growing dividends.

Please note this is only an opinion and not financial advice. Direct stock investing is subject to business and market risks. Therefore, it’s highly recommended to do proper risk management and your own due diligence before investing.