ALLE

Fundamental Analysis: Allegion plc

Company Overview:

- Allegion plc leads the global security market, known for its innovation and reliability.

- Its product range covers mechanical and electronic security solutions, catering to diverse needs.

- Allegion offers extensive services including maintenance and repair, ensuring customer satisfaction.

- Since 2013, Allegion has been headquartered in Dublin, driving industry innovation.

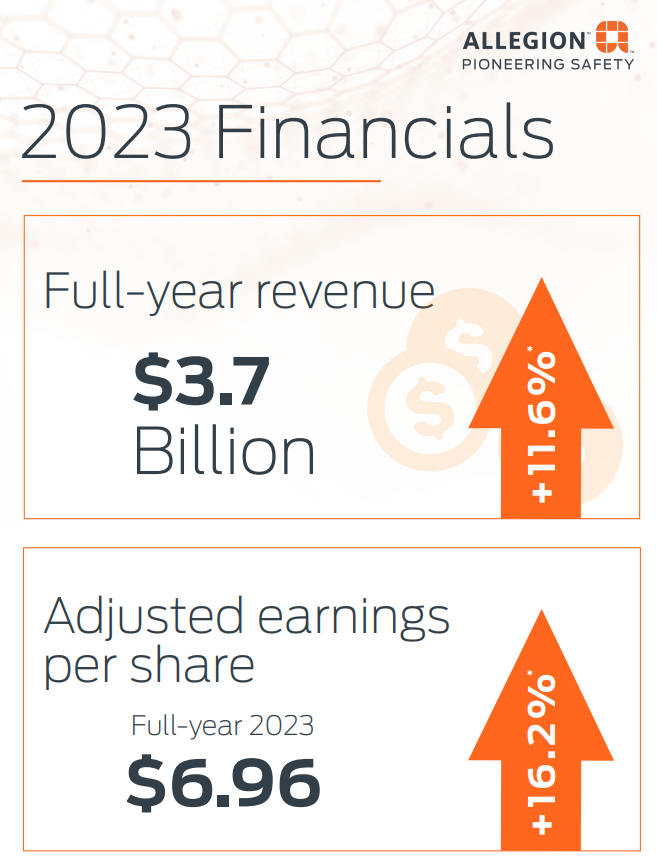

Company’s Financials:

- Earnings Growth Rate: 21.76% compounded annually over three years.

- ROIC:18.61 % efficiency in profit generation.

- ROE: 45.70% profitability relative to shareholders’ investment.

- Profit Margin: 14.80% of revenue retained as profit

Risk Factors:

- High Debt/Equity Ratio (1.53): Signifies potential financial vulnerability due to elevated debt levels compared to equity.

- High P/FCF Ratio (21.17): Implies overvaluation and potential constraints on future cash flow, posing risks for investors.

= For long-term investing, consider buying the stock when it reaches or falls below $105

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join our Discord community.

Our Articles on Long-Term Stock AnalysisMy best read on trading is this Book