Business Summary:

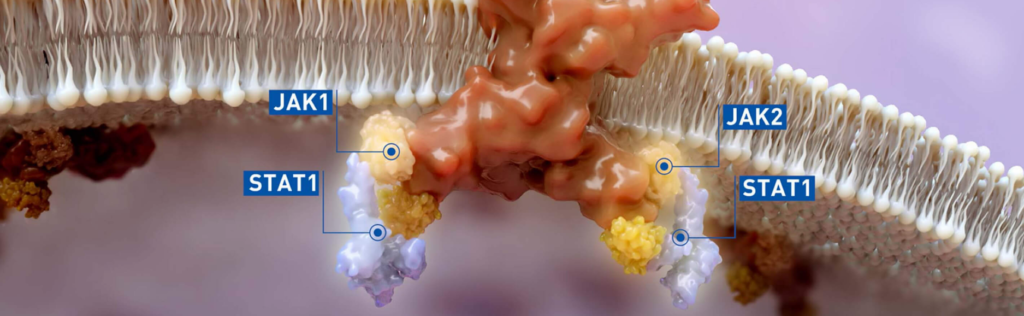

- Incyte Corporation is a biopharmaceutical firm dedicated to discovering, developing, and commercializing therapeutics.

- Incyte’s drug pipeline shows potential with promising candidates in different stages of development for treating cancer and inflammatory diseases, setting the stage for long-term growth.

- Incyte is recognized for its innovative therapies in oncology and inflammation.

- Despite challenges, Incyte remains resilient and has emerged as a leader in developing targeted therapies.

Why to Invest in Incyte Corporation (INCY):

- Incyte remains an appealing value proposition in the biotech sector, boasting robust free cash flow (with an average FCF margin of 26% in 2022) and a solid cash balance of $3 billion.

- JAKAFI’s underlying earnings are obscured by substantial R&D spending, which supports a diverse portfolio of opportunities to mitigate the JAKAFI LOE by 2028.

- Incyte seems poised to generate cash flows over the next six years that are more than double the cash flows of the previous six years.

- The company’s current valuation is modest, and coupled with potential product launches and acquisitions, there exists the possibility for future share price appreciation.

Risk on Investment:

- Despite its promising growth potential, the company’s significant decline in income and high GAAP P/E ratio could raise concerns among investors.

- The company’s stock performance and profitability have suffered, particularly due to the mixed response to Opzelura’s performance in the non segmental vitiligo market.

Fundamentals:

- Market Cap: 11.60 B

- EPS: 2.64

- PE: 19.55

- Debt To Equity: 0.63%

- Revenue: 3.69 B

- Gros Margin: 93.71%

Technicals:

- Stock is making a narrow zone from las six years and now ready for the big multi year breakout.

- Trading at the multi year support levels.

- RSI is also at oversold zone which increase the chances of bounce from current levels.

- Once it breakout the upper trendline resistance then it will shoot up to its all time high above 150.

- You can add some more quantity in your investment once it crosses above the 200 EMA.

Entry = 50

Stop Loss = 42

Targets = 70 / 95 / 130

Conclusion: Despite experiencing a significant 60% decline in its stock value over the last six years, Incyte has shown remarkable growth and profitability, coupled with minimal debt and a substantial cash reserve. The company’s solid liquidity position, with $3.4 billion in cash, enables strategic investment in research and development, especially with upcoming Phase II data on pipeline candidates being crucial. While Incyte boasts billions in revenues and modest growth, it faces significant challenges. Nonetheless, the current stock levels present an attractive opportunity for long-term investors, particularly with a substantial cash reserve providing a strong backup.

Please note this is only an opinion and not financial advice.

To get regular updates on stocks, please join our Discord community.

Our Articles on Long-Term Stock Analysis

My best read on trading is this Book