WHAT IS IN THE REPORT

- Icahn Enterprises (IEP), a holding company with a market worth of over $18 billion, is managed by activist investor and corporate raider Carl Icahn, who owns about 85% of the business along with his son Brett.

- According to our research, there are three main causes for the 75%+ overvaluation of IEP units:

(1) Compared to all comparable, IEP trades at a 218% premium to its most recent net asset value (NAV).

(2) We have found convincing evidence of inflated valuation marks for IEP’s less liquid and private assets

(3) Since our last disclosure, the firm has experienced more performance losses.

- The majority of closed-end holding firms trade around or below their NAVs. For comparison, companies managed by other prominent executives trade at discounts of 14% and 35% to NAV, respectively, including Dan Loeb’s Third Point and Bill Ackman’s Pershing Square.

- Based on an analysis of media targeted towards retail investors, one explanation for IEP’s extraordinary premium to NAV is that common investors are drawn to (a) IEP’s high dividend yield and (b) the chance to work with Wall Street titan Carl Icahn. There is hardly any ownership by institutions in IEP.

KEY FACTORS

Background and Bull Case: Invest With Legendary Corporate Raider Carl Icahn and Receive A 15.8% Dividend

The only significant sell-side firm that covers IEP, investment bank Jefferies, has consistently rated the stock as a “buy” and has assured retail investors that the dividend is secure “into perpetuity.”

The dividend yield of IEP and Icahn’s star status have also received attention from other retail investor-focused media outlets.

IEP trades at an absurd 218% premium to its most recent reported indicative net asset value (NAV).

In contrast, the majority of peers trade at a discount to NAV.

Icahn Enterprises trades at a higher premium to NAV than all 526 U.S.-based closed-end funds in Bloomberg’s database, according to our comparison.

Icahn’s investment portfolio has lost 53% since 2014, the year that coincided with the start of his successful Herbalife campaign and his last year of significant outperformance. This contrasts with the S&P 500’s 147% performance during the same time period.

Mathematically, Icahn’s dividends are unsustainable: since 2014, $1.5 billion in cash dividends have been paid despite $4.9 billion in negative free cash flow as a result of subpar performance.

Mathematically, Icahn’s dividends are unsustainable: since 2014, $1.5 billion in cash dividends have been paid despite $4.9 billion in negative free cash flow as a result of subpar performance.

The company has sold $1.7 billion through At The Market (ATM) unit sales over the past four years, supporting its dividend and declining asset values.

The sole sell-side analyst that covers IEP and the bookrunner for unit sales is Jefferies, which has assumed in its research notes that IEP’s dividend is secure in perpetuity.

To put it another way, Icahn has been using money from new investors to pay dividends to existing investors.

Icahn Enterprises is significantly overvalued in comparison to its most recent reported NAV, as explained above.

Our analysis also reveals that Icahn’s most recent reported NAV has been overstated by an estimated 22% as a result of (i) continuing investment losses until 2023, and (ii) overestimated valuation marks on less liquid investments.

Over 45% of IEP’s Gross Indicative Assets are made up of a $4.2 billion stake in Icahn’s Investment Fund, which has consistently underperformed.

The Performance Issue Seems to Be Persisting: Icahn began the year with a 47% net short position, which we estimated has contributed $272 million in losses so far this year as a result of gains in the broad market. Icahn’s disclosed long positions also declined, contributing an estimated $151 million in losses so far this year.

IEP’s second-largest component, accounting for 24% of NAV, is CVR Energy, a publicly traded company that is down 14.4% year to date and worth around $320 million in pro forma. NAV Decline CVR’s profitability and cash flow are likely to be under pressure going forward as a result of declining profitability indicators for the company, such as shrinking refinery margins and declining fertiliser prices.

A non-public automotive segment that has lost $207 million in operating cash flow over the past two years and is valued at over $1.5 billion with suspicious marks in less liquid assets is IEP’s third-largest component to NAV.

Example #1: Icahn owns 90% of a publicly traded meat packaging company.The company’s market cap was $89 million at year’s end, but Icahn Enterprises marked its position at $243 million, immediately applying a 204% premium to the price of its publicly traded shares.

Example #1 Continued: The Meat Packaging Industry Is Extremely Illiquid, With Only 129 Shares Trading ($143 Per Day) On The OTC Pink Sheets

Normally, In Such A Situation, One Would Apply A Significant Illiquidity Discount—Icahn Apparently Chose A Massive Illiquidity Premium

Marks of Suspicion in Less Liquid Assets Example #2: In December 2022, Icahn’s Auto Parts Division had a market value of $381 million, and a month later, its main subsidiary filed for bankruptcy.

Marks of Suspicion in Less Liquid Assets Example #3: Over the past four years, the marks in IEP’s “Real Estate” holdings, valued at $455 million, have remained remarkably stable.

This is despite the portfolio’s inclusion of (i) The Trump Plaza, which will be demolished in 2021; (ii) a country club that was on the verge of bankruptcy before being taken over by members; and (iii) a lack of transparency about the valuation and asset management of the portfolio’s assets.

The Abnormal Value Marks Follow A Pattern: Following notes that cited a “lack of transparency” and marks that are “divergent from their public market values,” among other issues like investment underperformance and a 60% premium to NAV, UBS discontinued its coverage of IEP in January 2020.

Financial flexibility is limited by IEP’s loan covenants since they prevent it from issuing new debt and only permit refinancing.

A risky form of financing that might lead to margin calls should unit prices decline, Carl Icahn has pledged 60% of his IEP units for margin loans.

Icahn has not provided unitholders with a full understanding of this risk by disclosing important terms of his margin loans, such as loan to value (LTV) or other important criteria.

Conclusion

A giant of Wall Street with a talent for winning, Carl Icahn has created an air of invincibility about himself. The focus has always been on his large-scale, visible activist efforts, but his business has been destroyed by quieter long-term financial losses as well as the heavy use of leverage.

Icahn’s financial wealth at this point is dependent on selling retail investors expensive IEP units while persuading them that they would be paid with a reliable, secure income for all time, despite overwhelming evidence to the contrary.

REPORT’S EFFECTS ON STOCK

After Hindenburg Research disclosed a short call against the investment firm, Icahn Enterprises LP experienced its steepest one-day drop @-20% in history. This was just the latest major blow dealt by the well-known short-seller on Wall Street.

EFFECTS ON COMPANIES AFTER HINDENBERG’S RESEARCH

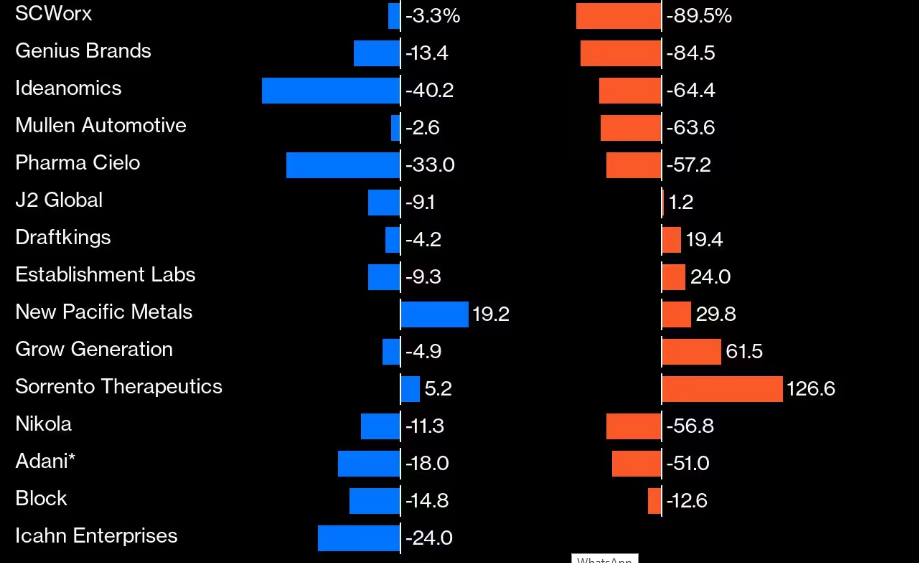

| COMPANY | PERFORMANCE 1D | PERFORMANCE 3M |

*PER=PERFORMENCE

*MTH=MONTH

Must read book about investing – check here