Please note this is only an opinion and not financial advice. Direct stock investing is subject to business and market risks. Therefore, it’s highly recommended to do proper risk management and your own due diligence before investing.

As of 15 March 2023

Visa Inc.(VISA:NASDAQ)

Visa provides following services:

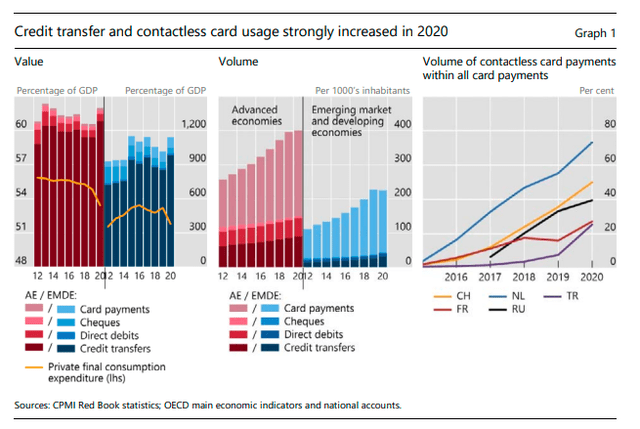

- Payment Network: Visa operates a global payment network that connects millions of merchants, financial institutions, and consumers.

- Payment Products: Visa offers a range of payment products, including credit cards, debit cards, prepaid cards, and digital wallets.

- Interchange Fees: Visa charges interchange fees to financial institutions for processing transactions on its network.

What we think are pros of business:

- Wide acceptance

- High transaction volume

- Fraud prevention

- Convenience

What we think the risks are:

- Fees

- Dependence on technology

- Regulations

- Competition

Fundamentals:

- Market Cap: 460 Billion

- P/E : 26

- D/E : 0.57

- Operating Cash Flow: $14,000 Million average

- Profit margins = 65%

- ROE= 42.17%

- P/FCF= 26.51

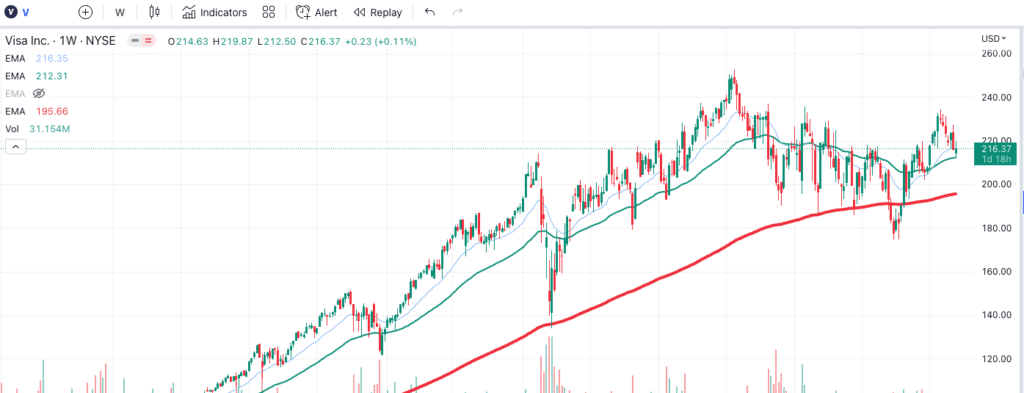

Technical for long term perspective:

Trend : Sideways

Entry : enter around 190 and DCA if it comes to 140 levels

Target: Short term target is 240 but in long term it can be goes 380

Our Final Thought:

Visa Inc. has a moat and it can survive huge downturns in the market. The balance sheet is pretty strong with strong fundamentals. If you are looking for an inflation beating business then Visa can be one your picks.

Please note this is only an opinion and not financial advice. Direct stock investing is subject to business and market risks. Therefore, it’s highly recommended to do proper risk management and your own due diligence before investing.