Stress Test Analysis

SEBI had directed mutual funds to stress test their small-cap funds to determine how soon they could sell them amid bad market circumstances.

Mutual funds have published stress test data on the capabilities of their small- and mid-cap funds to withstand abrupt redemptions, as directed by SEBI. Examine the stress results of the top ten small-cap funds, which demonstrate how rapidly they can sell 25% and 50% of their holdings.

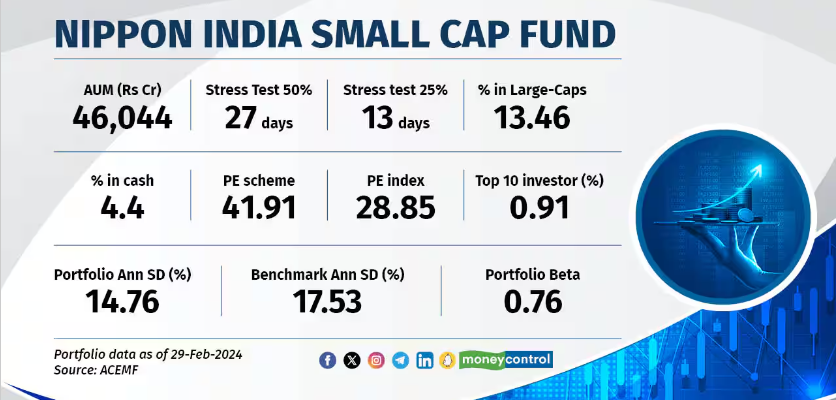

The largest small-cap fund by AUM (Rs 46,044 crore), Nippon’s fund, would liquidate 25% of its assets in 13 days and sell 50% in 27 days.

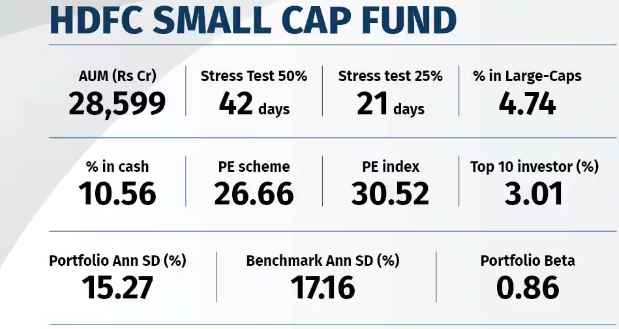

The HDFC small-cap fund will take 21 days to sell 25% of its assets, and 42 days to dispose 50%.

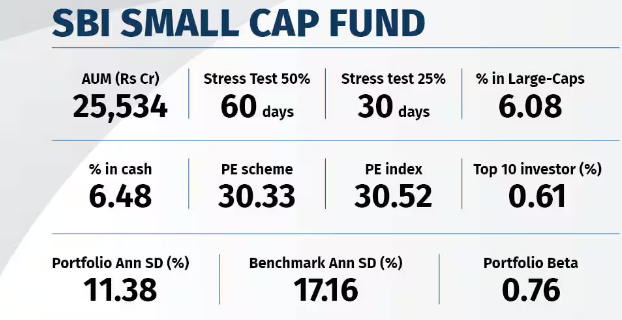

The SBI small-cap fund will take 30 days to sell 25% of its holdings and 60 days to dispose 50%.

The Axis Small-Cap Fund will take 14 days to sell 25% of its holdings and 28 days to liquidate 50%.

The Quant small-cap fund will take 11 days to sell 25% of its assets and 22 days to liquidate 50%.

The Kotak Small-Cap Fund will take 17 days to sell 25% of its assets and 33 days to dispose 50%.

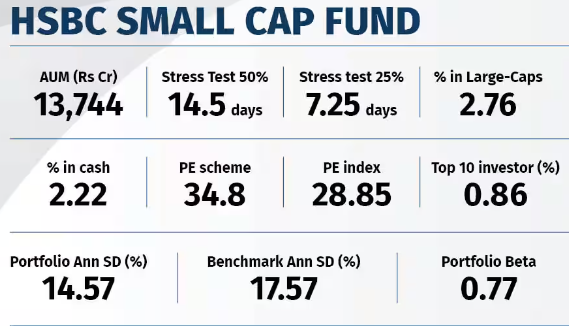

The HSBC Small-Cap Fund will take 7.25 days to sell 25% of its assets and 14.5 days to dispose 50%.

Franklin India Smaller Company Fund will take 6 days to sell 25% of its assets and 12 days to dispose 50%.

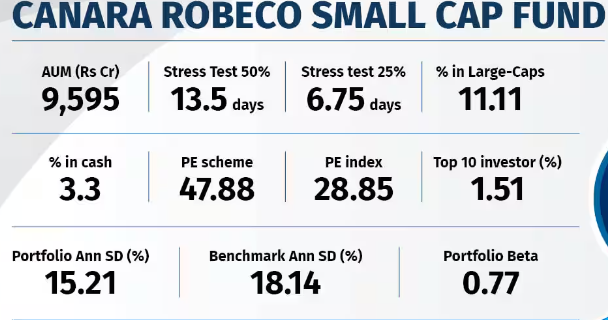

Canara Robeco’s small-cap fund will take 6.75 days to sell 25% of its assets, and 13.5 days to liquidate 50%.