Please note this is only an opinion and not financial advice. Direct stock investing is subject to business and market risks. Therefore, it’s highly recommended to do proper risk management and your own due diligence before investing.

Growth Stock Analysis as of 06 January 2024

Top Growth Stock

NASDAQ: Walgreens Boots Alliance, Inc. (WBA)

- Walgreens Boots Alliance, Inc. functions as a healthcare, pharmacy, and retail corporation with operations spanning the United States, the United Kingdom, Germany, and various international locations.

- The U.S. Retail Pharmacy segment manages retail drugstores, health services, specialty and home delivery pharmacy services, providing a range of products including health and wellness items, beauty products, personal care, consumables, and general merchandise.

- Walgreens Boots Alliance, Inc. was founded in 1909 and is headquartered in Deerfield, Illinois.

- WBA employs approximately 330,000 people and has a presence in eight countries through its portfolio of consumer brands: Walgreens, Boots, Duane Reade, the No7 Beauty Company and Benavides in Mexico.

- A trusted, global innovator in retail pharmacy with more than 12,500 locations across the U.S., Europe and Latin America, WBA plays a critical role in the healthcare ecosystem.

- Walgreens Boots Alliance still faces challenges such as higher labor costs, lower COVID-related demand, and leadership transition.

Shareholding Patterns of The Estée Lauder Companies Inc.:

| Holder | Shares | Date Reported | % Out | Value |

|---|---|---|---|---|

| Vanguard Group Inc | 86,675,198 | Sep 29, 2023 | 10.03% | 2,167,746,721 |

| Blackrock Inc. | 66,034,496 | Sep 29, 2023 | 7.64% | 1,651,522,760 |

| State Street Corporation | 54,236,704 | Sep 29, 2023 | 6.28% | 1,356,459,979 |

| Invesco Ltd. | 17,026,420 | Sep 29, 2023 | 1.97% | 425,830,768 |

| Geode Capital Management, LLC | 16,143,413 | Sep 29, 2023 | 1.87% | 403,746,762 |

| Capital World Investors | 14,285,331 | Sep 29, 2023 | 1.65% | 357,276,131 |

| Morgan Stanley | 12,584,371 | Sep 29, 2023 | 1.46% | 314,735,121 |

| Northern Trust Corporation | 7,703,403 | Sep 29, 2023 | 0.89% | 192,662,110 |

| ProShares Advisors, LLC | 6,941,236 | Sep 29, 2023 | 0.80% | 173,600,313 |

| Legal & General Group PLC | 6,645,586 | Sep 29, 2023 | 0.77% | 166,206,107 |

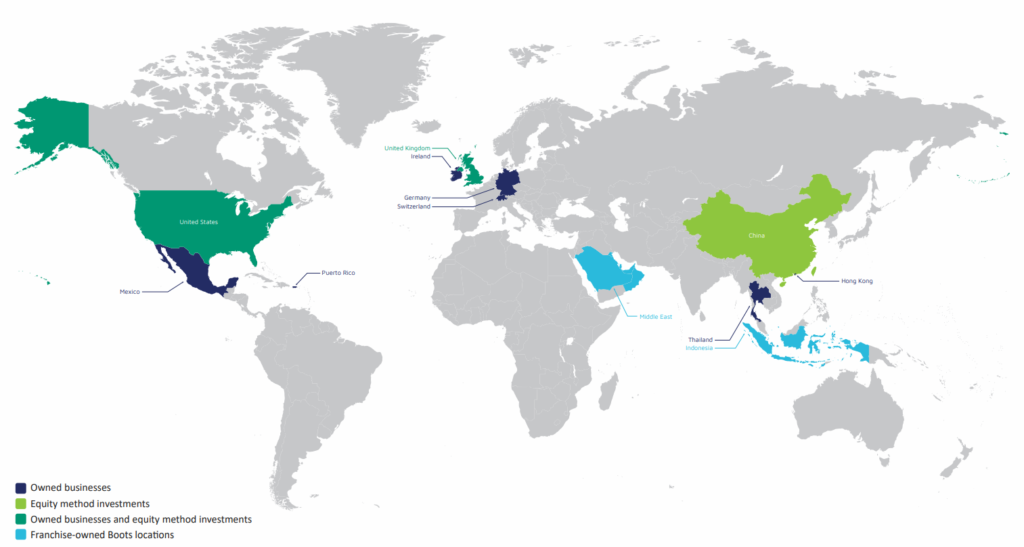

Global Presence of Walgreens Boots Alliance, Inc.

What we think are pros of business:

- The extensive array of well-regarded brands in their portfolio creates a substantial economic advantage for the company, historically resulting in significant returns on invested capital.

- From a technical perspective, Walgreens stock has reached a significant support level, and its current undervaluation suggests that investing in WBA might be a worthwhile opportunity at this juncture.

- Walgreens Boots Alliance potentially generating over $3 billion in free cash flow soon makes the stock appear undervalued.

- U.S. Healthcare business looks promising, given a couple of positive trends in this field. American people are becoming more health-conscious in general, and this trend has also been fueled by the pandemic

- Revenue has actually grown consistently under this segment, climbing from $20.51 billion to $22.18 billion over the past three years.

What we think the risks are:

- The company the poorest performer in the Dow Jones Industrial Average (DIA), but it also ranks among the 20 lowest-performing stocks in the S&P 500

- Walgreens Boots Alliance missed the entire bull market of the last almost 14 years and the stock is trading close to the 2009 lows once again.

- Walgreens Boots Alliance cut dividends by a huge 48% as it continued to report GAAP losses in Q1 FY24.

- Negative publicity, product recalls, or controversies can harm brand reputation and customer trust.

- The company has dramatically reduced its dividends, which is disappointing for investors going by its hefty TTM yield.

Fundamentals:

- Market Cap: 21.57 Billion

- Revenue: 142.4 Billion

- 52 Week Range: 19.68 – 37.96

- Dividend: 1 (4%)

- EPS: 0.66

- PE: 37.89

Technical for a long-term perspective:

– Stock is trading near the 25 years lower support zone which is technically a very bullish sign for near future.

– If you look at the chart on Daily time frame then it has already given a breakout and retested its breakout levels. Now preparing for a bounce.

– Volumes has also increased in the last few months indicating the high interest of buyers at this price levels.

– If you want to trade with high confirmation then you can plan to enter only above its EMA levels.

– There is a small chance of pullback again, which you can take as an opportunity to add more stocks at lower levels.

– Don’t book profit early, you can ride the profit with trailing Stoploss for bigger targets.

– RSI is slightly bearish which may go down slowly and then bounce towards higher levels again.

Entry = 25

Stop Loss = 18

Target = 40 / 56 / 87

Our Final Thought:

Key catalysts for Walgreens Boots Alliance include new leadership, ongoing cost-control efforts, and synergistic opportunities among its segments. Despite recent profitability issues, the company is in a strong financial position. It significantly reduced its debt, using proceeds from selling assets. Current long-term debt stands at around $9 billion, down from a peak of approximately $18 billion. This conservative financial approach, with a lower debt-equity ratio compared to CVS, supports the company’s initiatives and dividends.

As on the Technical view, it seems very bullish for the upcoming few months and it has a great potential for upside momentum and it must be follow higher high patterns in the upcoming weeks and can give you minimum of 100% returns in this year 2024.

Please note this is only an opinion and not financial advice. Direct stock investing is subject to business and market risks. Therefore, it’s highly recommended to do proper risk management and your own due diligence before investing.

More Articles on Longterm Stock Analysis

Join our Discord Community for the Latest News Updates and Trading Ideas.