Trimming Positions

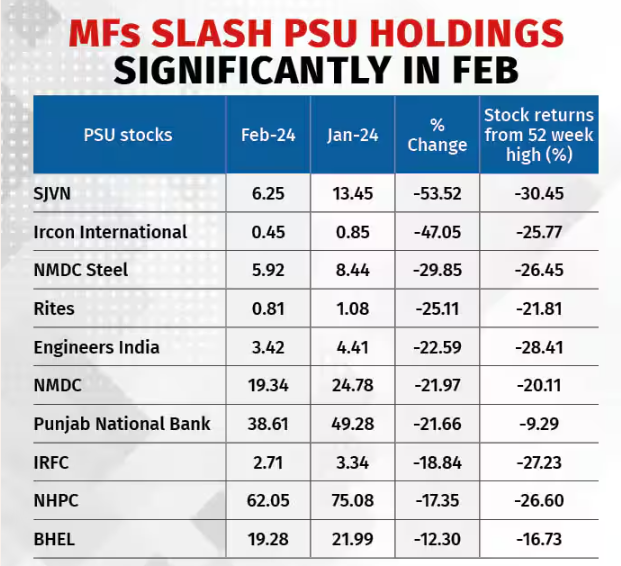

SJVN had the highest sell-off, cutting stakes by almost 53%, followed by Ircon International and NMDC Steel by 47% and 30%, respectively.

Mutual funds withdrawn over Rs 3,500 crore from state-run company equities in February due to concerns about inflated valuations and lack of earnings backing.

The BSE PSU index fell 7% from its 52-week high on March 6, but the index performance masks price harm in some “frothy and speculative” counters, including NBCC India, Mishra Dhatu Nigam, RCFL, MMTC, KIOCL, SJVN, and RVNL.

Fund houses now own Rs 4.2 lakh crore in PSU stakes, up from Rs 3.95 lakh crore in February. Mutual funds divested the most in SJVN (53%), followed by Ircon International (47%), and NMDC Steel (30%). End-February fund houses had 6.25 crore SJVN shares worth Rs 757 crore, down from 13.45 crore in January. SJVN shares fell 30% from their February peak due to the selloff.

Ircon International’s mutual fund holdings dropped from 85 lakh shares worth Rs 201 crore to 45 lakh shares valued at Rs 103 crore in February, resulting in a 25% drop in Ircon stock. NMDC Steel’s mutual fund holdings were 5.92 crore shares, valued at 363 crore rupees, down from 588 crore rupees at the end of January. To reduce their holdings in RITES from 1.08 crore shares to 81.16 lakh shares valued at Rs 634 crore, fund houses sold 27.21 lakh shares.

Engineers India and NMDC sold 99.65 lakh and 5.45 crore shares, reducing their ownership to 3.42 crore and 19.33 crore shares, respectively. The disposal of 10.67 crore shares in Punjab National Bank brought the total number of shares in the funds to around 38.6 crore, down from 49.28 crore a month ago.

On one hand, there are many who believe the rally has more room to expand due to profits growth and P/e expansion prospects, while on the other hand, there are many who have pointed out the increasing speculative nature of certain counters. However, the vast undervaluation of state-owned enterprises has ended, according to most analysts and fund managers, so investors must now be more stock-specific.

Kotak Institutional Equities has noted that the rise in PSU stocks like IRFC, BHEL, and SJVN is primarily due to general optimism rather than significant changes in the companies’ fundamentals. Analysts believe that there was excitement about these stocks, but wrong expectations and prices were put on them.

They believe that government policies may help in the short term but may make it harder for PSUs to deal with long-term threats and invest in successful projects. This could hinder their ability to invest in future success.

Over the last three years, the Public Sector Units (PSUs) basket has shown significant results due to better profit outlooks resulting from good government policies. This has led to PSUs closing the value gap with their private counterparts. Ankit Jain, senior fund manager at Mirae Asset Investment Managers, suggests that investors should be more stock-specific in the PSU basket, as high prices of good government companies are not a good investment as there is no way to get money back.

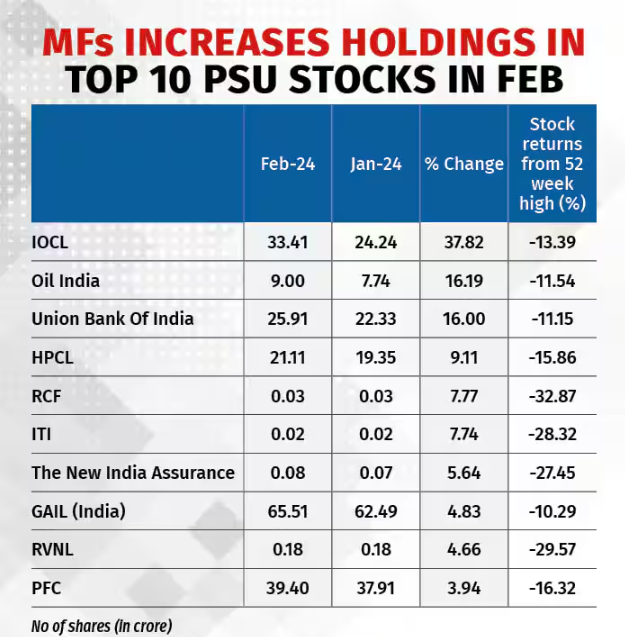

However, PSUs have built unique moats and skills in certain fields, such as borrowing money more cheaply in power companies and obtaining liability licenses better than public sector banks. During the sell-off, some PSUs were bought, with funds owning more shares in Indian Oil Corporation, Oil India, Union Bank of India, and Hindustan Petroleum. The funds’ holdings have also increased by 12.4%.

PSU stocks saw mutual fund buying of 1%-4%, including Indian Bank, Oil and Natural Gas Corporation, Hindustan Aeronautics, Coal India, Gujarat Gas, Power Grid Corporation, Cochin Shipyard, Power Finance Corporation, Rail Vikas Nigam, GAIL India, New India Assurance, and Rashtriya Chemicals and Fertilisers.

Ajay Bagga argues that the PSU story has been overdone, overhyped, and oversold, suggesting caution in exiting institutional investors.

Must read book about investing – check here Trimming Positions Trimming Positions Trimming Positions Trimming Positions Trimming Positions