Value Watch

Diversified company strategy with strong free cash flows.

Highlights:

- BAT retains 25.5 percent share post the stake sale

- Stable tax regime in cigarette business to help gain market share

- Operating leverage to further unfold in the FMCG business

- Focus on value-added products for Paperboards and agri business

- Hotel business in a sweet spot due to demand-supply mismatch

- Superior free cash flow yield vs peers

- Investors can accumulate on declines

After BAT’s share sale, ITC stock is passed the supply overhang. The major stakeholder is BAT.

ITC (CMP: Rs 420; Market cap: Rs 5,23,972 crore; Rating: Overweight).

BAT sold its 3.5 percent ITC interest to purchase back its parent shares. To ease its US cigarette business woes and parent company debt, it allegedly sold some of its ITC ownership. BAT still owns 25.5% of ITC following the block sale.

In the recent eight months, ITC’s stock price has consolidated due to slow FMCG volume growth, moderate cigarette volume growth, and BAT’s monetisation plan’s supply overhang.

We believe investors may ride this diverse business model with respectable dividend yield at the current pricing.

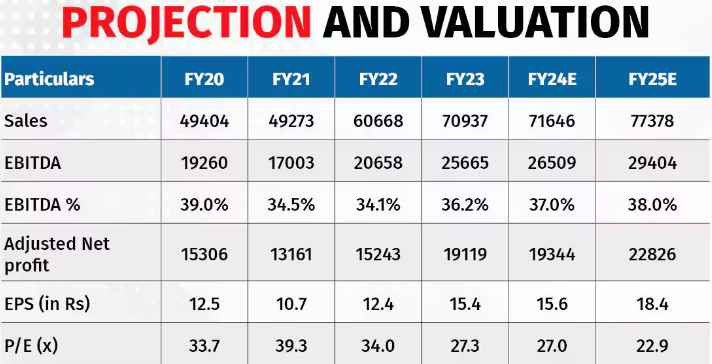

Outlook and value

The company’s cash cow, the main tobacco industry (40 percent of sales), with its high EBIT margin (63 percent) and inelastic demand, will continue to support and incubate other development engines. It should gain market share due to its stable tax regime, falling illegal cigarette volume, and innovative goods.

FMCG sales (28 percent of sales) is also appealing. An large product selection across categories can help FMCG expand profitably. Despite a slow rural market, the firm delivers operational leverage. The FMCG top-line increased 7.6% last quarter, while EBIT grew 24%. Compared to market leader HUL (24 percent), the EBITDA margin is still low at 11 percent.

Due to the demand-supply mismatch and structural cost reduction during Covid, we expect the hotel business to continue rising. Agri and Paperboard should stabilize with value-added goods.

After the hotel de-merger (anticipated September–October 2024), ITC’s return profile (RoCE: 39%) could improve.

Finally, ITC outperforms FMCG peers with a 2.6 percent free cash flow yield. It merits a premium value relative to its tobacco sector counterparts due to its diverse growth potential.