Bank of Canada

Bank of Canada : Tracing the inferred path of interest rates and what the BOC will consider.

The Bank of Canada meets eight times in 2024, and the market now expects five or six rate decreases.

The first question is when they will begin. The next BOC meeting is on January 24, but it comes on the heels of a shockingly strong inflation report. CPI jumped 3.1% year on year, compared to the 2.9% forecast, while the core measure also rose more than expected.

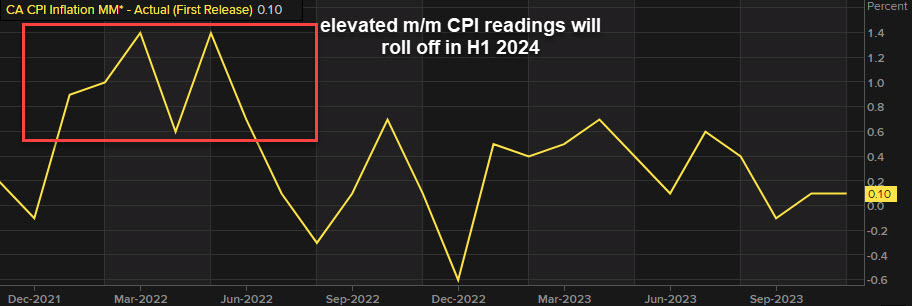

However, that is not the last word. The December CPI data will be announced on January 16, and a 0.3% increase from December 2022 could assist on the core side. However, the y/y headline figure is expected to grow much more since a -0.6% reading from a year ago is removed from the equation. This might cause headline CPI to rise over 3.5%, tying BOC Governor Tiff Macklem’s hands.

A month later, the converse is true, with a high headline number disappearing but a low core measure keeping it up.

With the February CPI data, all of the year-over-year statistics will finally get some aid, and a true downturn will take hold. However, that data item will not be released until after the BOC meeting on March 6.

That meeting is now priced at 45% for a cut, which seems about appropriate. I can easily imagine the BOC waiting to see how the CPI statistics come in and then holding rates until the April 10 meeting.

The case for them to cut is likewise solid, and it is based in part on the assumption that they will look south for clues. They’ll have to wait till the FOMC meets on March 20, right? No, I don’t believe so. The Fed always aggressively indicates what it will do before to the meeting, and the blackout begins on March 8, so the BOC is likely to know what the Fed will do. The March Fed meeting is currently at 100%, so if that does not change, I would expect the BOC to move to the front of the line. It’s also worth noting that the March ECB meeting follows the BOC by one day.

In any case, the 10th of April will very probably be live. Current price is at 100% – almost precisely –with the June 5 meeting pricing 72 basis points away.

Returning to the CPI figures, the headlines were so heated from January to May 2023 that they will gradually fade. So, by next June, we might be looking at extremely low Canadian CPI figures.

Cuts are fully priced for three of the four remaining meetings in 2024, with a 40% discount for the fourth.

That brings us back to housing; by June, we’ll have a fair notion of how the spring housing market will pan out. If banks continue to be hesitant to pass on reduced market rates, we may be in danger. The odds are that we will experience moderate pain, at which time I believe the BOC will blink and 50 bps cuts will begin. I’ll also be keeping a careful eye on Canadian consumer spending, which has been struggling recently.

What about the year 2025?

The OIS market is currently pricing in around 225 basis points in cumulative cuts through 2025, bringing the BOC to 2.75%. I believe they will wind up around 1.75%, which is where they were before the epidemic in 2019.

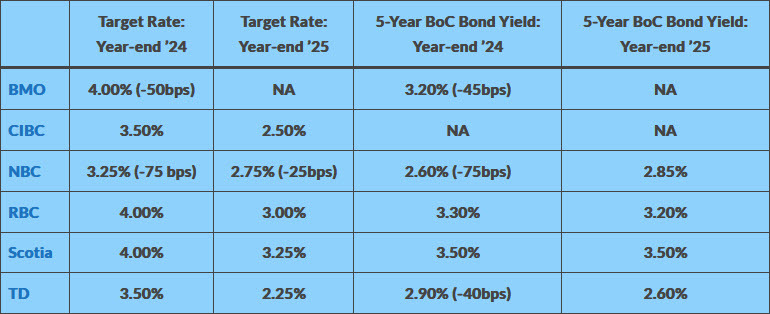

In comparison, here are the estimates from Canada’s major banks, as provided by Steve Hueble of Canadian Mortgage Trends:

Must read book about investing – check here

Bank of Canada Bank of Canada Bank of Canada Bank of Canada Bank of Canada