Key Events shows Flash PMIs, the US Consumer Confidence, the RBA and SNB rate decisions and the US Jobless Claims.

Monday – Sep 23

Monday will be the Flash PMIs Day for many major economies with the Eurozone, UK and US PMIs being the main highlights:

- Eurozone Manufacturing PMI: 45.6 expected vs. 45.8 prior.

- Eurozone Services PMI: 52.1 expected vs. 52.9 prior.

- UK Manufacturing PMI: 52.5 expected vs. 52.5 prior.

- UK Services PMI: 53.5 expected vs. 53.7 prior.

- US Manufacturing PMI: 48.5 expected vs. 47.9 prior.

- US Services PMI: 55.3 expected vs. 55.7 prior.

Key Events on watch

US

- 8:00 AM ET Fed’s Bostic Gives Speech on Economic Outlook

- 8:30 AM ET National Activity index for August

- 9:45 AM ET S&P Global Manufacturing PMI, Sept flash

- 9:45 AM ET S&P Global Services PMI, Sept flash

- 9:45 AM ET S&P Global Composite, Sept flash

- 10:15 AM ET Fed’s Goolsbee Speaks in Fireside Chat

Global

- Japan on Holiday,

- Australia/Eurozone/UK/US Flash PMIs.

Other key events

- BMO Capital Dallas & Austin Property Tour, 9/24-9/27, in Dallas, Tx

- Deutsche Bank 32nd Annual Leveraged Finance Conference, 9/23-9/25, in Scottsdale, AZ

- RBC Capital Pharmaceutical CDMO & Bioprocessing Conference, 9/23-9/24

Tuesday – Sep 24

RBA

- RBA’s Expected Cash Rate: 4.35%

- Maintained hawkish stance amid high inflation.

- First rate cut expected in February 2025.

- Total easing expected at 101 bps by year-end.

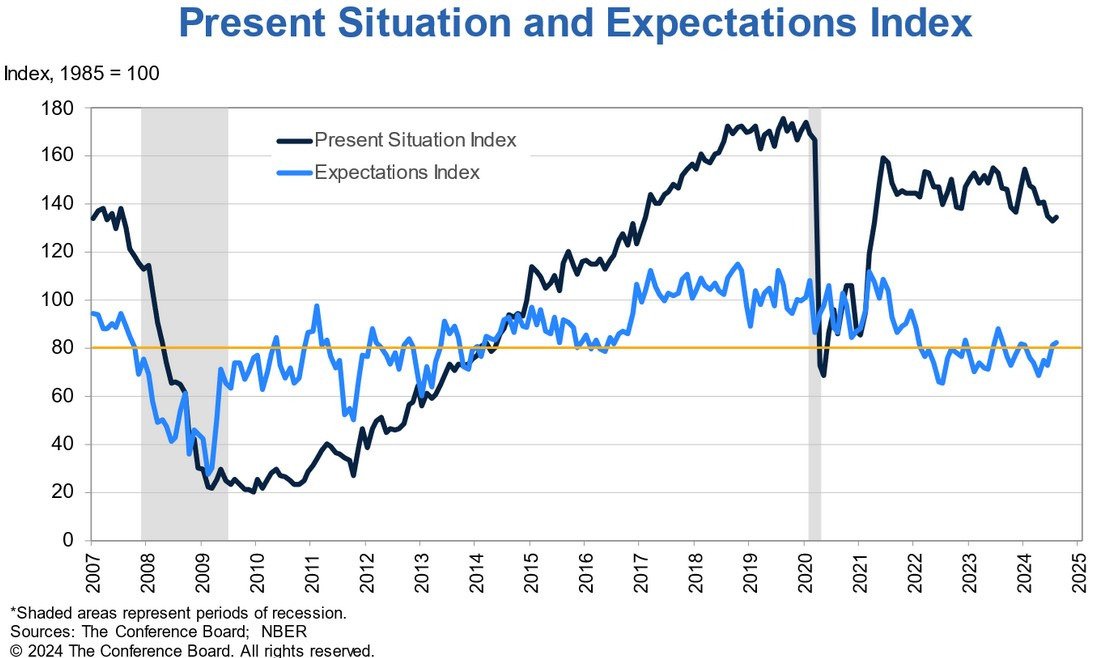

US Consumer Confidence

- US Consumer Confidence Expected at 103.8 vs 103.3

- Consumer confidence rose in August, but remained within narrow range.

- Mixed feelings expressed in August: more positive about business conditions, more concerned about labor market.

Key Events on watch

US

- 7:45 AM ET ICSC Weekly Retail Sales

- 8:55 AM ET Johnson/Redbook Weekly Sales

- 9:00 AM ET Monthly Home Prices M/M for July

- 9:00 AM ET CaseShiller 20 City index for July

- 10:00 AM ET Consumer Confidence for September

- 10:00 AM ET Richmond Fed Index for September

- 1:00 PM ET U.S. Treasury to sell $69B in 2-year notes

- 4:30 PM ET API Weekly Inventory Data

Global

- Japan Flash PMI,

- RBA Policy Decision,

- German IFO,

- US Consumer Confidence.

Other key events

- BMO Capital Dallas & Austin Property Tour, 9/24-9/27, in Dallas, Tx

- Deutsche Bank 32nd Annual Leveraged Finance Conference, 9/23-9/25, in Scottsdale, AZ

- Oppenheimer Innovating Sustainability Summit, 9/24

- RBC Capital Pharmaceutical CDMO & Bioprocessing Conference, 9/23-9/24

- RBC Capital Global Communications Infrastructure Conference 9/24-9/25, in Chicago, IL

- RBC Capital Global Industrials Conference 9/24-9/25, in Las Vegas

Wednesday –Sep 25

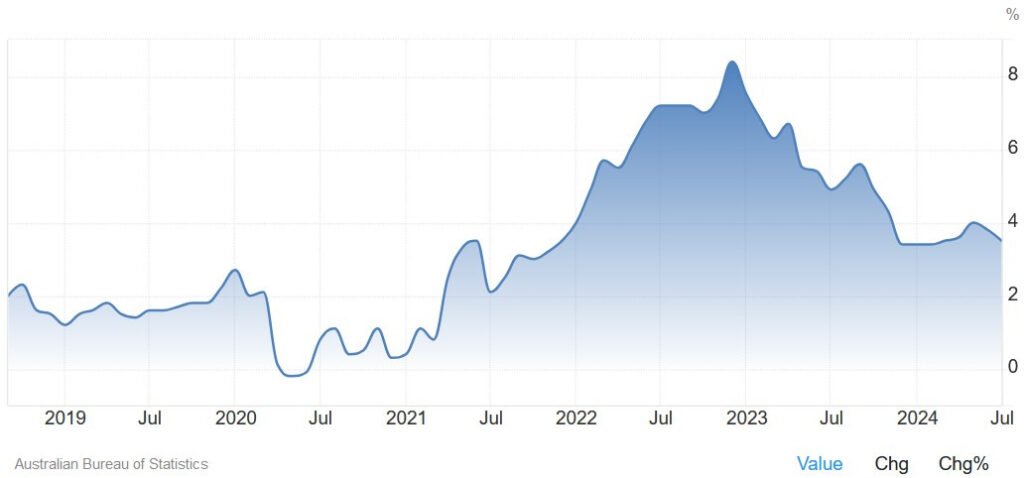

Australian Monthly CPI

- Australian Monthly CPI Expected at 3.1% Y/Y

- Expected increase from 3.5% prior.

- RBA Governor Bullock predicts more data to confirm inflation return to target.

- Release unlikely to alter inflation outlook unless significant deviations occur.

Key Events on watch

US

- 7:00 AM ET MBA Mortgage Applications Data

- 10:00 AM ET New Home Sales M/M for August

- 10:30 AM ET Weekly DOE Inventory Data

- 1:00 PM ET U.S> treasury to sell $70B in 5-year notes

Global

- Australia Monthly CPI.

Other Key Events:

- BMO Capital Dallas & Austin Property Tour, 9/24-9/27, in Dallas, Tx

- Deutsche Bank 32nd Annual Leveraged Finance Conference, 9/23-9/25, in Scottsdale, AZ

- RBC Capital Global Communications Infrastructure Conference 9/24-9/25, in Chicago, IL

- RBC Capital Global Industrials Conference 9/24-9/25, in Las Vegas

Thursday – Sep 26

Swiss National Bank (SNB) Expected Rate Cut

- SNB expected to cut rates by 25 bps, bringing policy rate to 1.00%.

- Market predicts a 45% probability of a larger 50 bps cut due to unexpected inflation drop to 1.1%.

- SNB’s Jordan stated that Swiss Franc strength is affecting Swiss industry.

- High likelihood of a 50 bps cut or currency intervention threat.

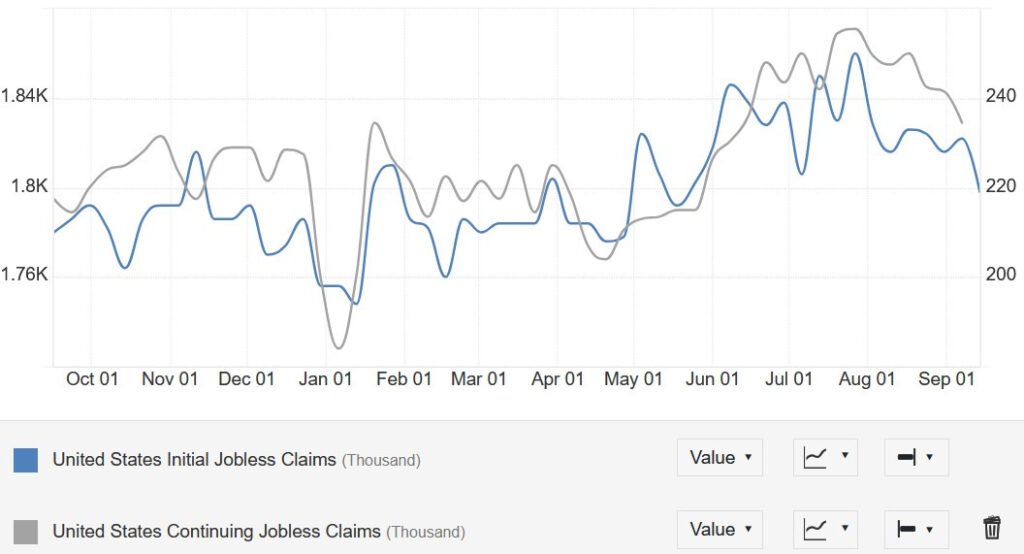

US Jobless Claims Weekly Update

- Initial Claims remain within 200K-260K range since 2022.

- Continuing Claims have shown sustained rise in the last weeks.

- This week’s Initial Claims expected at 225K, a decrease from 219K.

- No consensus on Continuing Claims at this time, with a previous drop to 1829K.

Key Events on watch

USA

- 8:30 AM ET Weekly Jobless Claims

- 8:30 AM ET Continuing Claims

- 8:30 AM ET Gross Domestic Product (GDP) Q2 Final

- 8:30 AM ET GDP Consumer Spending Q2 final

- 8:30 AM ET GDP Price Deflator Q2 final

- 8:30 AM ET PCE Prices for Q2 final

- 8:30 AM ET Core PCE Prices for Q2 final

- 8:30 AM ET Durable Goods Orders for August

- 9:10 AM ET Fed’s Collins, Kugler Participate in Fireside Chat

- 9:25 AM ET Fed’s Williams Gives Remarks at Conference

- 10:00 AM ET Pending Home Sales M/M for August

- 10:30 AM ET Weekly EIA Natural Gas Inventory Data

- 10:30 AM ET Fed’s Barr Gives Remarks at Conference

- 11:00 AM ET Kansas City Fed Manufacturing for September

- 1:00 PM ET U.S. Treasury to sell $44B in 7-year notes

Global

- SNB Policy Decision

- US Durable Goods Orders

- US Q2 Final GDP

- US Jobless Claims.

Other Key Events:

- BMO Capital Dallas & Austin Property Tour, 9/24-9/27, in Dallas, Tx

- Goldman Sachs European Real Estate Equity and Debt Conference, 9/26, in London

- Oppenheimer Oncology Summit at MD Anderson, 9/26

Friday –Sep 27

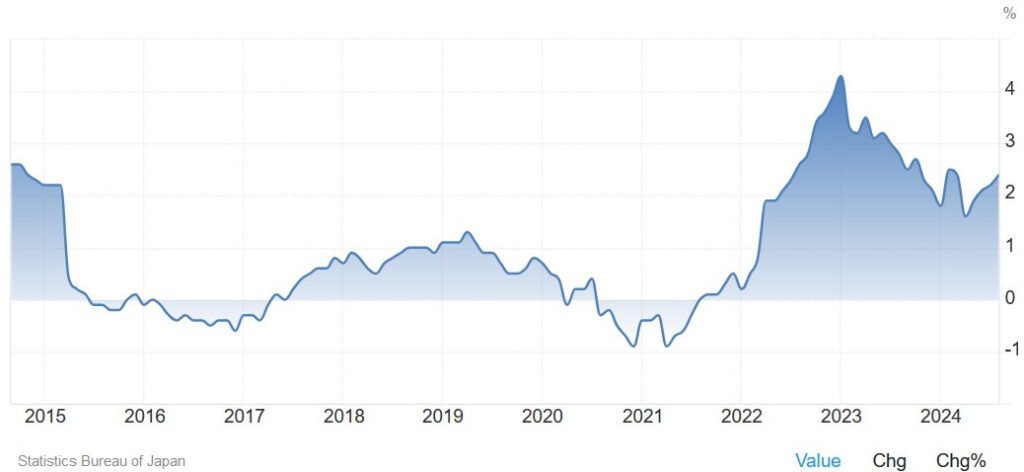

Tokyo Core CPI

- Tokyo Core CPI Expected to Increase to 2.0% Y/Y

- Tokyo CPI is a leading indicator for National CPI, making it more important for market than National figure.

- BoJ policy decision unchanged, Governor Ueda dovish due to decreased upside price risks from recent FX moves.

US PCE Y/Y Expectations

- Expected at 2.3% vs. 2.5% prior.

- M/M figure at 0.1% vs. 0.2% prior.

- Core PCE Y/Y expected at 2.7% vs. 2.6% prior.

- M/M reading at 0.2% vs. 0.2% prior.

- PCE estimates reliable once CPI and PPI are out.

- Fed’s Waller expects 0.14% on Core M/M measure.

- Inflation data less important due to Fed’s focus on labour market.

Key Events on watch

USA

- 8:30 AM ET Personal Income for August

- 8:30 AM ET Personal Spending for August

- 8:30 AM ET PCE Prices Index M/M for August

- 8:30 AM ET PCE Prices Index Y/Y for August

- 8:30 AM ET Core-PCE Prices Index M/M for August

- 8:30 AM ET Core-PCE Prices Index Y/Y for August

- 8:30 AM ET Advance Goods Trade Balance for August

- 10:00 AM ET University of Michigan Confidence, Sept-Final

- 10:00 AM ET University of Michigan 1-yr and 5-yr inflation expectations, Sept-final

- 1:00 PM ET Baker Hughes Weekly rig count data

Global

- Tokyo CPI,

- Canada GDP,

- US PCE.

Must read book about investing – check here

The US PPI Y/Y is expected to rise by 2.3%, while the M/M measure is expected to decrease by 0.1%. However, the sentiment will be set by the CPI report.