Key Events shows on the data front, the upcoming week is going to be more calm.

Monday – Sep 09

Key Events on watch

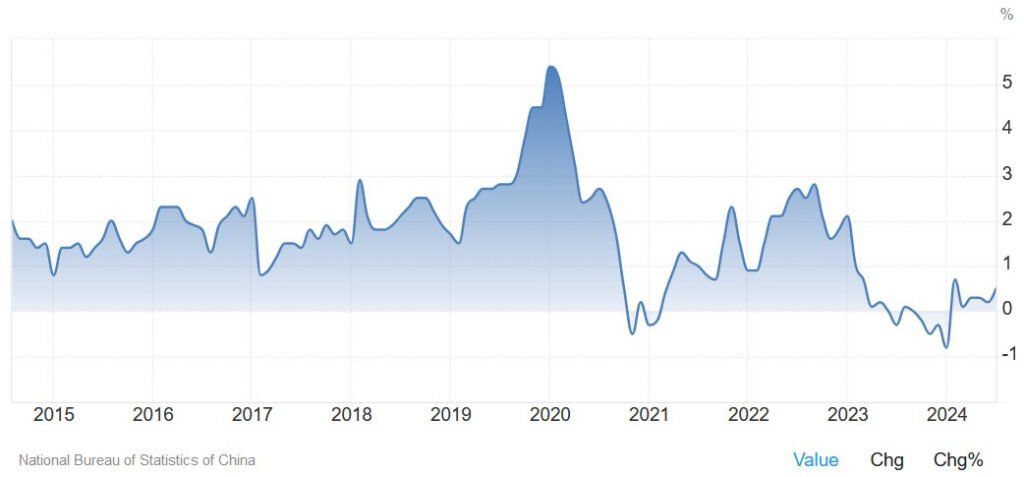

Chinese CPI Expectations

- Y/Y CPI: 0.7% vs 0.5% prior.

- M/M CPI: 0.5% vs 0.5% prior.

- High real rates in China despite economic need for low or negative rates.

- Slow support pledges by Chinese officials.

US

- 10:00 AM ET Employment Trends for August

- 10:00 AM ET Wholesale Inventory M/M for July

- 3:00 PM ET Consumer Credit for July

Global

- China CPI

Other key events

- Apple (AAPL) holding product event where new iPhone launch expected

- Goldman Sachs 12th Annual CEEMEA Financials Symposium, 9/9 in London

- Goldman Sachs Communacopia & Technology Conference, 9/9-9/12, in San Francisco, CA

- Oracle (ORCL) Cloud World 2024, 9/9-9/12, in Las Vegas, NV

- Roth MKM 11th Annual Solar & Storage Symposium at SPI, 9/9-9/12, in Anaheim, CA

- Wells Fargo Net Lease REIT Forum, 9/9 in New York

Tuesday – Sep 10

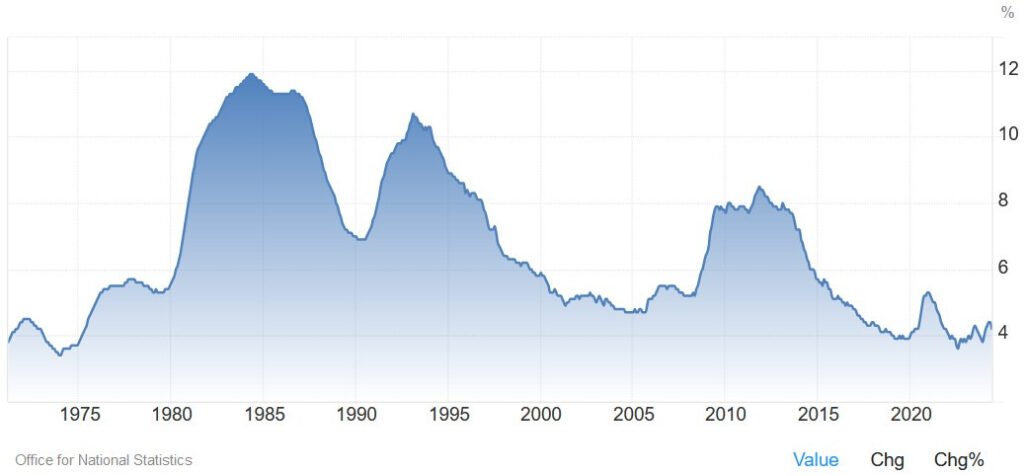

UK Labour Market Report:

- Expected 114K jobs added in July vs 97K in June.

- Unemployment Rate to decrease to 4.1% from 4.2%.

- Average Earnings including Bonus expected at 4.1% from 4.5%.

- Average Earnings excluding Bonus expected at 5.1% from 5.4%.

- 83% probability of no change at BoE meeting.

- Expected 43 bps of easing by year-end.

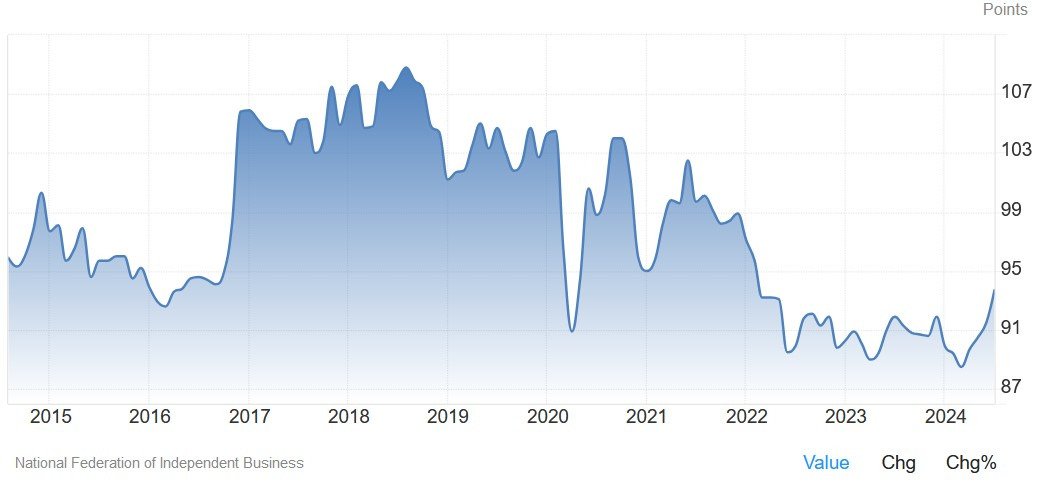

US NFIB Small Business Optimism Index Expected at 93.6

- Expected to rise from 93.7 prior.

- Empty week with market focused on growth.

- NFIB index recently broke out of 2022 range, reaching new cycle high at 93.6.

Key Events on watch

US

- 6:00 AM ET NFIB Small business Optimism for August

- 7:45 AM ET ICSC Weekly Retail Sales

- 8:55 AM ET Johnson/Redbook Weekly Sales

- 1:00 PM ET US Treasury to sell $58B in 3-year notes

- 4:30 PM ET API Weekly Inventory Data

Global

- UK Labour Market report

- US NFIB Business Optimism Index.

Other key events

- BTIG GameDay: iGaming and Sports Betting Forum, 9/10 in New York

- Goldman Sachs Communacopia & Technology Conference, 9/9-9/12, in San Francisco, CA

- Oracle (ORCL) Cloud World 2024, 9/9-9/12, in Las Vegas, NV

- Roth MKM 11th Annual Solar & Storage Symposium at SPI, 9/9-9/12, in Anaheim, CA

Wednesday –Sep 11

US CPI Y/Y Expectations

- Expected at 2.6% vs. 2.9% prior.

- M/M measure at 0.2% vs. 0.2% prior.

- Core CPI Y/Y at 3.2% vs. 3.2% prior.

- M/M figure at 0.2% vs. 0.2% prior.

- Fed focuses on labour market.

- Inflation surprises have less significance.

- Soft report may push expectations for a 50 bps cut back around 50%.

Key Events on watch

US

- 7:00 AM ET MBA Mortgage Applications Data

- 8:30 AM ET Consumer Price Index (CPI) M/M

- 8:30 AM ET Consumer Price Index (CPI) Y/Y

- 8:30 AM ET CPI Core – Ex: Food & Energy M/M

- 8:30 AM ET CPI Core – Ex: Food & Energy Y/Y

- 10:30 AM ET Weekly DOE Inventory Data

- 11:00 AM ET Cleveland Fed CPI for August

- 1:00 PM ET US Treasury to sell $42B in 10-year notes

Global

- UK GDP

- US CPI.

Other Key Events:

- Goldman Sachs Communacopia & Technology Conference, 9/9-9/12, in San Francisco, CA

- Goldman Sachs China+ Conference 2024, 9/11-9/12 in Hon Kong

- JP Morgan Alternative Solutions and Specials Symposium, 9/11-9/12, in South Pointe

- Oppenheimer Southern California MedTech Bus Tour (RXST, EW, TNDM, DXCM), 9/11

- Oracle (ORCL) Cloud World 2024, 9/9-9/12, in Las Vegas, NV

- Roth MKM 11th Annual Solar & Storage Symposium at SPI, 9/9-9/12, in Anaheim, CA

Thursday – Sep 12

ECB Expected Rate Cut

- Expected to cut by 25 bps, bringing policy rate to 3.50%.

- Strong telegraphed since July.

- Market expects 25 bps cuts at each meeting until June 2025.

- President Lagarde may not explicitly commit to back-to-back cut in October.

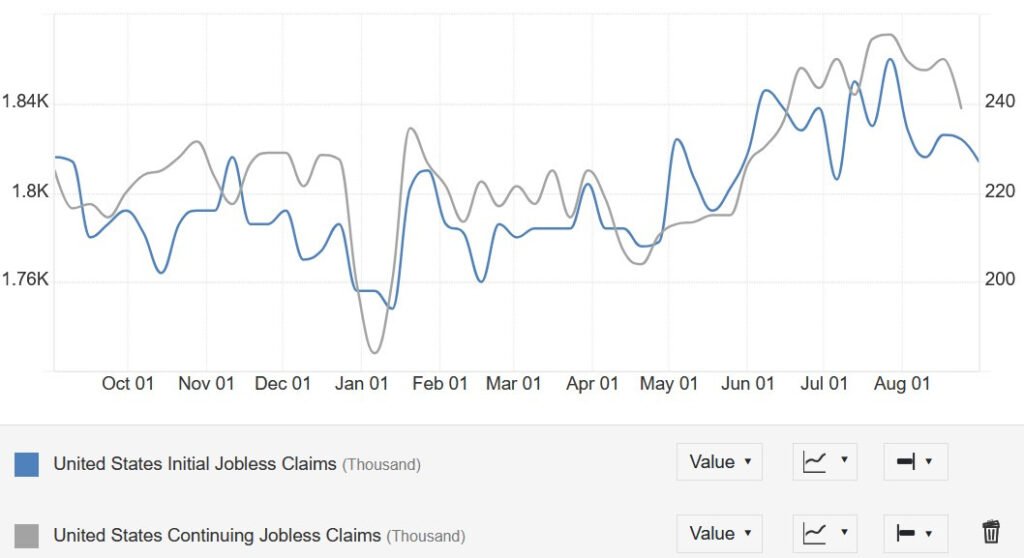

US Jobless Claims Weekly Update

- Initial Claims remain within 200K-260K range since 2022.

- Continuing Claims show sustained rise, indicating low layoffs and subdued hiring.

- Expected Initial Claims: 230K vs. 227K this week.

- Continuing Claims: 1850K vs. 1838K prior.

Key Events on watch

USA

- 8:30 AM ET Weekly Jobless Claims

- 8:30 AM ET Continuing Claims

- 8:30 AM ET Producer Price Index (PPI) M/M

- 8:30 AM ET Producer Price Index (PPI) Y/Y

- 8:30 AM ET PPI Core – Ex: Food & Energy M/M

- 8:30 AM ET PPI Core – Ex: Food & Energy Y/Y

- 10:30 AM ET Weekly EIA Natural Gas Inventory Data

- 12:00 PM ET WASDE Agricultural report

- 1:00 PM ET US Treasury to sell $25B in 30-year notes

- 2:00 PM ET Federal Budget for August

Global

- Japan PPI, ECB Policy Decision

- US PPI

- US Jobless Claims.

Other Key Events:

- Goldman Sachs Communacopia & Technology Conference, 9/9-9/12, in San Francisco, CA

- Goldman Sachs China+ Conference 2024, 9/11-9/12 in Hon Kong

- JP Morgan Alternative Solutions and Specials Symposium, 9/11-9/12, in South Pointe

- Oracle (ORCL) Cloud World 2024, 9/9-9/12, in Las Vegas, NV

- Roth MKM 11th Annual Solar & Storage Symposium at SPI, 9/9-9/12, in Anaheim, CA

Friday –Sep 13

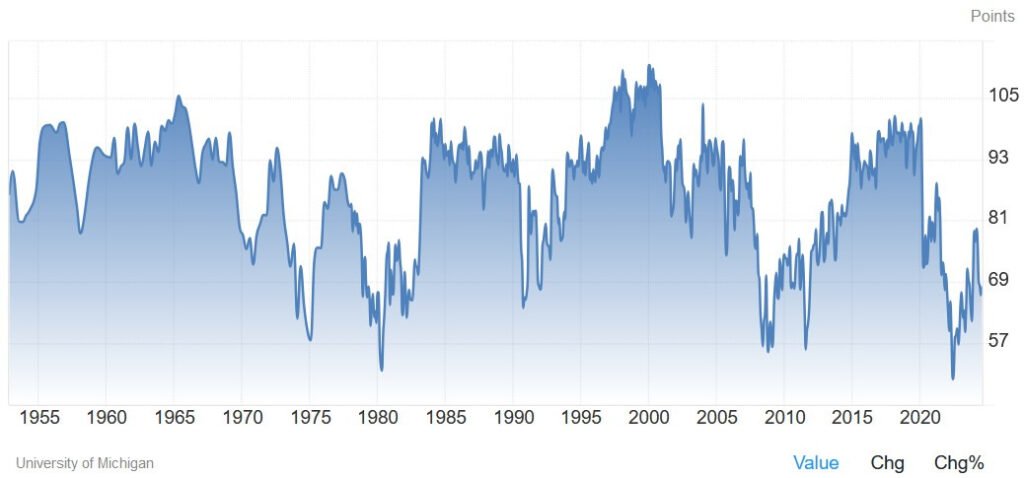

University of Michigan Consumer Sentiment Expectation

- Expected to reach 68.0 vs. 67.9 prior.

- More significant at business cycle turning points.

- Market closely monitored due to focus on growth.

Key Events on watch

USA

- 8:30 AM ET Import/Export Prices for August

- 10:00 AM University of Michigan Confidence

- 10:00 AM ET University of Michigan 1&5yr inflation exp

- 1:00 PM ET Baker Hughes Weekly rig count data

Global

- New Zealand Manufacturing PMI

- US University of Michigan Consumer Sentiment.

Other Key Events:

- European Society for Medical Oncology Congress (ESMO), 9/13-9/17, in Barcelona, Spain

Must read book about investing – check here

The US PPI Y/Y is expected to rise by 2.3%, while the M/M measure is expected to decrease by 0.1%. However, the sentiment will be set by the CPI report.