Week Ahead:- Over 900 companies, including Nifty 50 names like Bharti Airtel, Oil and Natural Gas Corporation, Eicher Motors, and Grasim Industries, are set to release their quarterly earnings this week.

The Nifty 50 breached the 25,000 mark, but failed to maintain it due to selling pressure on August 2. Rising recession fears in the US, weaker-than-expected job data, and selling by foreign institutional investors dampened global market sentiment.

However, a sharp drop in oil prices helped limit losses. The market is expected to consolidate with a negative bias, with key factors including RBI monetary policy, corporate earnings, and oil prices.

Key factors for upcoming week

RBI Policy Expectations

- Global experts anticipate Fed funds rate cut in September.

- Monetary Policy Committee’s meeting on August 8 to determine repo rate.

- Expected to remain at 6.5% due to upward food price pressure on CPI inflation.

- Market participants will follow RBI’s commentary on interest rate cuts timeline.

900 Companies to Announce Quarterly Earnings

Nifty 50 companies like Bharti Airtel, Eicher Motors, and Grasim Industries to release quarterly earnings.

Other companies include Shree Cement, Lupin, Bharti Hexacom, Tata Power, Life Insurance Corporation of India, ABB India, Oil India, Marico, PB Fintech, Honasa Consumer, Bosch, Vedanta, Power Finance Corporation, TVS Motor, Exicom Tele-Systems, Keystone Realtors, Sun Pharma Advanced Research Company, Tata Chemicals, Bata India, Blue Star, Cummins India, Gland Pharma, Gujarat Gas, PI Industries, Aditya Birla Fashion and Retail, Apollo Tyres, Godrej Consumer Products, NHPC, Alembic Pharmaceuticals, Bharat Forge, Biocon, Sobha, Alkem Laboratories, Bharat Dynamics, Berger Paints, Engineers India, General Insurance Corporation of India, Jubilant FoodWorks, Info Edge, Zydus Lifesciences, and Aurobindo Pharma.

Domestic Economic Data

HSBC Services PMI Data Release

- Services PMI rose to 61.1 in July, highest since March.

- Bank loan and deposit growth for fortnight ended July 26.

- Foreign exchange reserves for week ended August 2 to be released on August 9.

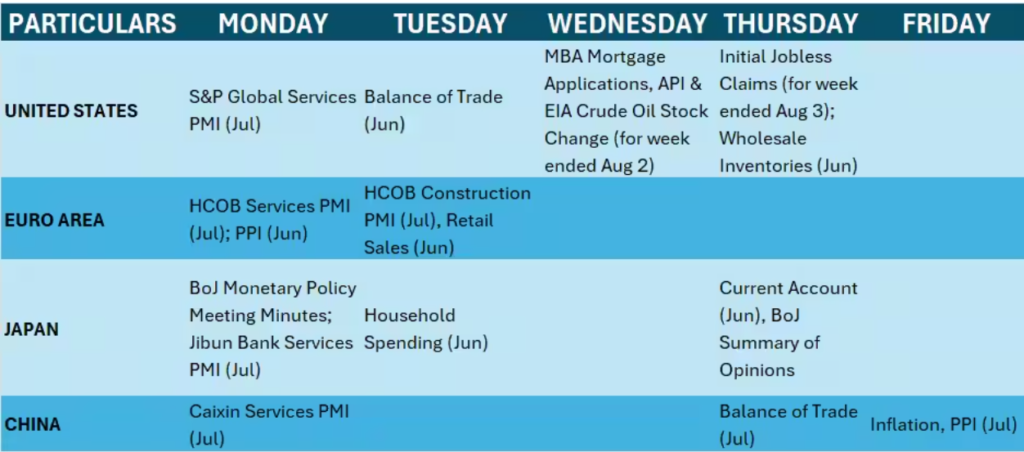

Global Economic Data

- China’s inflation & PPI numbers for July.

- Market participants monitor Services PMI data from major nations.

- Weekly US jobs data.

OIL

Global Crude Oil Prices Drop

- Crude oil prices plummeted amid U.S. recession concerns and weak job data.

- Brent crude futures ended the week at $76.81 per barrel, lowest since December 2023.

- This is the fourth consecutive week of declines.

- Prices are trading below the 200 EMA, providing relief for India, a major net oil importer.

FID/DII Flow

- FIIs likely to focus on U.S. economy and markets due to weak jobs data and the U.S. 10-year Treasury yield falling below 4.2%.

- Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are key to watch.

- Foreign investment in Indian equities has been inconsistent, contrasting with steady buying from domestic investors.

- FIIs sold shares worth Rs 12,756 crore in the cash segment, while DIIs purchased shares worth Rs 17,226 crore.

IPO

- Brainbees Solutions to open Rs 4,194-crore IPO on August 6.

- Unicommerce eSolutions IPO subscription to start on the same day.

- Ceigall India to close its public issue on August 5.

- Ola Electric Mobility’s IPO to open on August 6.

- Aesthetik Engineers to open its IPO on August 8.

- Dhariwalcorp IPO to close on August 5.

- Afcom Holdings’ maiden public issues and Picture Post Studios’ initial share sale to close on August 6.

- Akums Drugs and Pharmaceuticals to debut on the bourses on August 6.

- Ola Electric shares to be listed on August 9.

- SMEs to be listed on August 6.

- Trading in Utssav Cz Gold Jewels shares to commence effective August 7.

Technical View

- Expected to experience further weakness and consolidation in the coming week.

- Sharp selling pressure following a new high of 25,078.

- Formation of bearish candlestick pattern with higher volumes.

- Index may reach support at 24,600-24,400 before rebound.

- Immediate resistance: 24,900.

- Next support: 24,200 if closes below 24,400.

FO Cues

- 24100-24,000 is the key support zone for Nifty.

- The immediate hurdle is 24,800, followed by the 25,000 mark.

- Maximum open interest on Call side: 26,000 strike, followed by 25,000 and 25,500 strikes.

- Maximum open interest on Put front: 24,000 strike, followed by 24,100 and 23,500 strikes.

- Volatility spiked sharply, making bulls uncomfortable.

- India VIX jumped 16.92 percent to 14.32, from 12.25 levels.

Corporate Action

- Major companies like Britannia Industries, Eicher Motors, CEAT Ltd, Bharti Airtel, BPCL, Castrol India, Hindalco trade ex-dividend.

- Other actions include share buybacks, bonus issues, and stock splits.

Must read book about investing – check here Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead Week Ahead