Key Events shows We’ve finally made it to the first Fed rate cut. Will it be 25 or 50 bps?

Monday – Sep 16

Key Events on watch

US

- 8:30 AM ET Empire Manufacturing

Global

- New Zealand Services PMI.

Tuesday – Sep 17

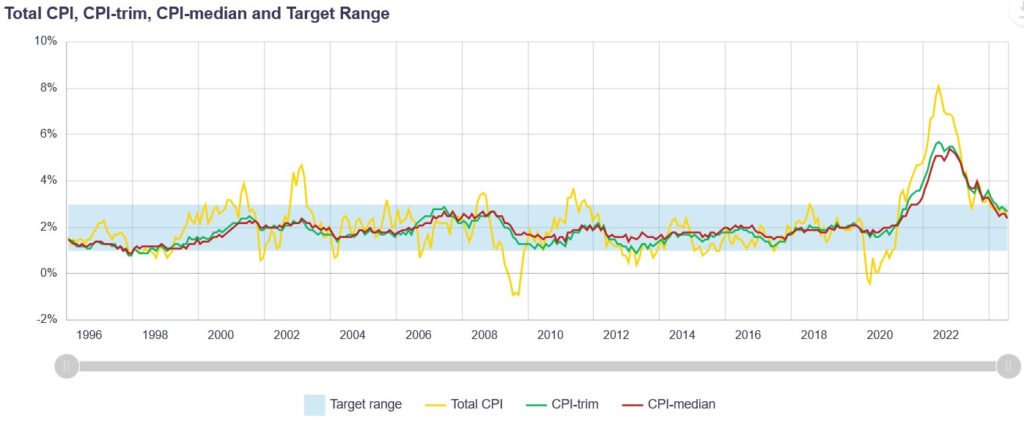

Canadian CPI Y/Y Expectations

- Expected to be 2.1% vs. 2.5% prior.

- M/M measure expected to be 0.0% vs. 0.4% prior.

- Focus on underlying inflation measures.

- Trimmed Mean CPI Y/Y expected to be 2.5% vs. 2.7% prior.

- Median CPI Y/Y expected to be 2.3% vs. 2.4% prior.

- BoC expected to cut rates by 25 bps at last two meetings.

- Potential for bigger rate cuts if growth and inflation are weaker than projected.

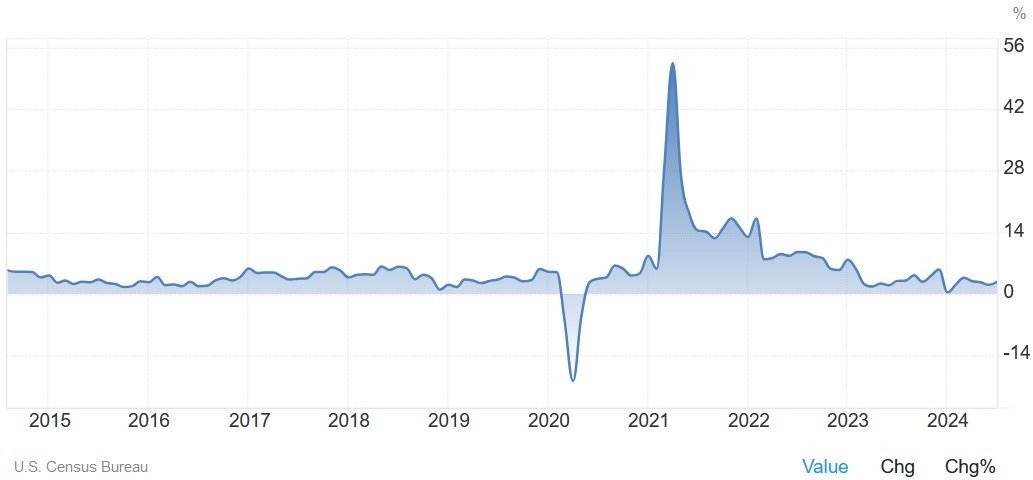

US Retail Sales M/M Expectations

- Expected at 0.2% vs 1.0% prior.

- Ex-Autos M/M expected at 0.3% vs 0.4% prior.

- Control Group figure expected at 0.2% vs 0.3% prior.

- Consumer spending stable due to positive real wage growth and resilient labor market.

- Steady pickup in UMich Consumer Sentiment indicating stable/improving financial situation.

Key Events on watch

US

- 7:45 AM ET ICSC Weekly Retail Sales

- 8:30 AM ET Retail Sales M/M for August

- 8:30 AM ET Retail Sales – Less Autos M/M

- 8:55 AM ET Johnson/Redbook Weekly Sales

- 9:15 AM ET Industrial Production M/M

- 9:15 AM ET Capacity Utilization M/M for August

- 10:00 AM ET Business Inventories M/M for July

- 10:00 AM ET NAHB Housing Market Index

- 1:00 PM ET US Treasury to sell $16B in 20-year notes

- 4:30 PM ET API Weekly Inventory Data

Global

- Eurozone ZEW,

- Canada CPI,

- US Retail Sales,

- US Industrial Production and Capacity Utilization,

- US NAHB Housing Market Index.

Other key events

- Cantor Global Healthcare Conference, 9/17-9/19, in New York

- Goldman Sachs European Communacopia Conference, 9/17-9/18, in London

- Salesforce.com (CRM) Dreamforce Conference 9/17-9/19, in San Francisco, CA

- Truist Semiconductors Bus Tour

Wednesday –Sep 18

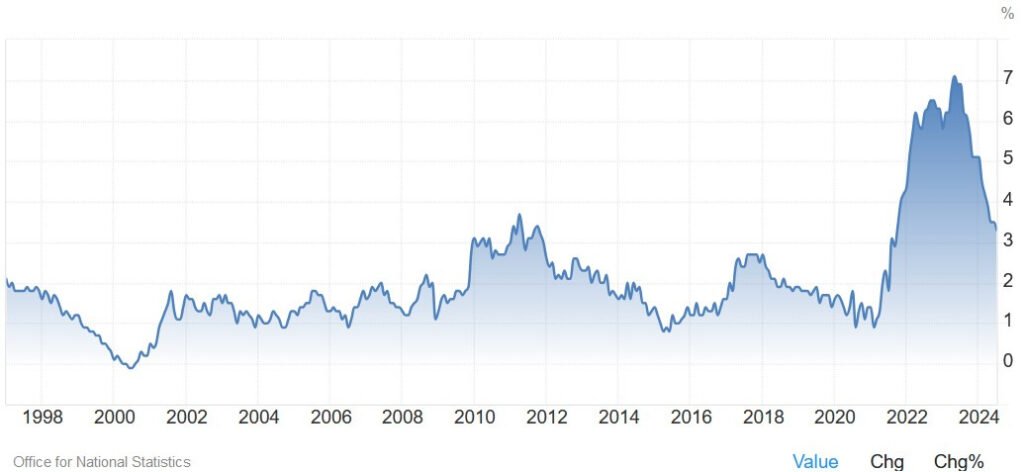

UK CPI Y/Y Expectations

- Expected 2.2% increase from 2.2% prior.

- M/M measure: 0.3% increase from -0.2% prior.

- Core CPI Y/Y: 3.5% increase from 3.3% prior.

- M/M measure: 0.4% increase from 0.1% prior.

- BoE expected to maintain rates at upcoming meeting..

Economists’ Consensus on Fed Rate Cut

- Economists predict a 25 bps cut by the Fed.

- Market pricing evenly splits between 25 and 50 bps cuts.

- Some suggest starting with a standard 25 bps due to economic stability.

- Central banking focuses on risk management.

- Market pricing provides Fed with opportunity to deliver a 50 bps “insurance cut.”

Key Events on watch

US

- 7:00 AM ET MBA Mortgage Applications Data

- 8:30 AM ET Housing Starts M/M for August

- 8:30 AM ET Building Permits M/M for August

- 10:30 AM ET Weekly DOE Inventory Data

- 2:00 PM ET FOMC Policy meeting; 25bps interest rate cut expected

- 4:00 PM ET Net Long-term TIC Flows for July

Global

- UK CPI,

- US Housing Starts and Building Permits,

- BoC Summary of Deliberations,

- FOMC Policy Decision.

Other Key Events:

- Cantor Global Healthcare Conference, 9/17-9/19, in New York

- DA Davidson 23rd Annual Diversified Industrials and Services Conference, 9/18-9/20 in Nashville, TN

- Goldman Sachs European Communacopia Conference, 9/17-9/18, in London

- Salesforce.com (CRM) Dreamforce Conference 9/17-9/19, in San Francisco, CA

Thursday – Sep 19

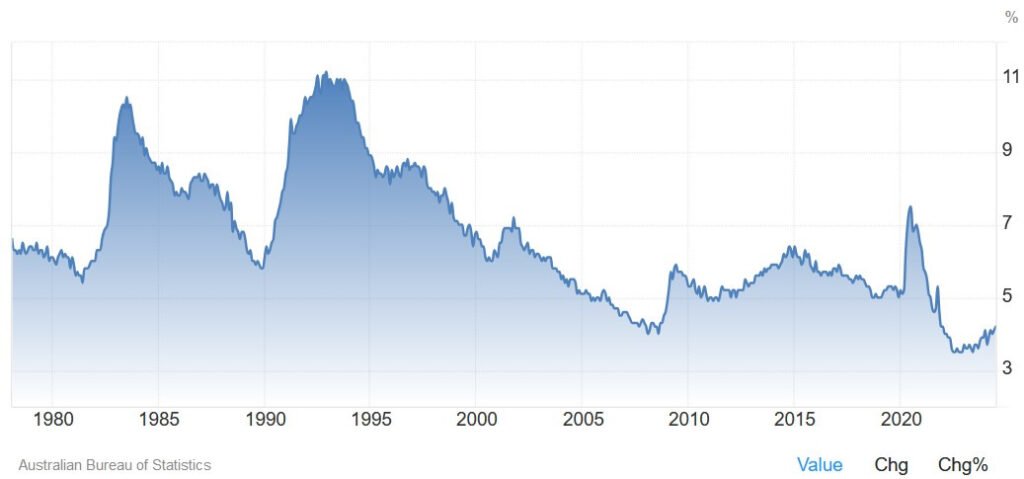

Australian Labour Market Report:

- Expected 30.0K jobs added in August vs. 58.2K in July.

- Unemployment Rate remains at 4.2%.

- RBA expected to deliver first rate cut in February 2025.

- Probabilities can be extended to December 2024 if data is disappointing.

BoE Expected Rates Unchanged

- BoE to maintain 5.00% rates.

- Strong data: PMIs expansion, slow inflation, lower unemployment rate.

- Market anticipates 25 bps central bank cut in November and December.

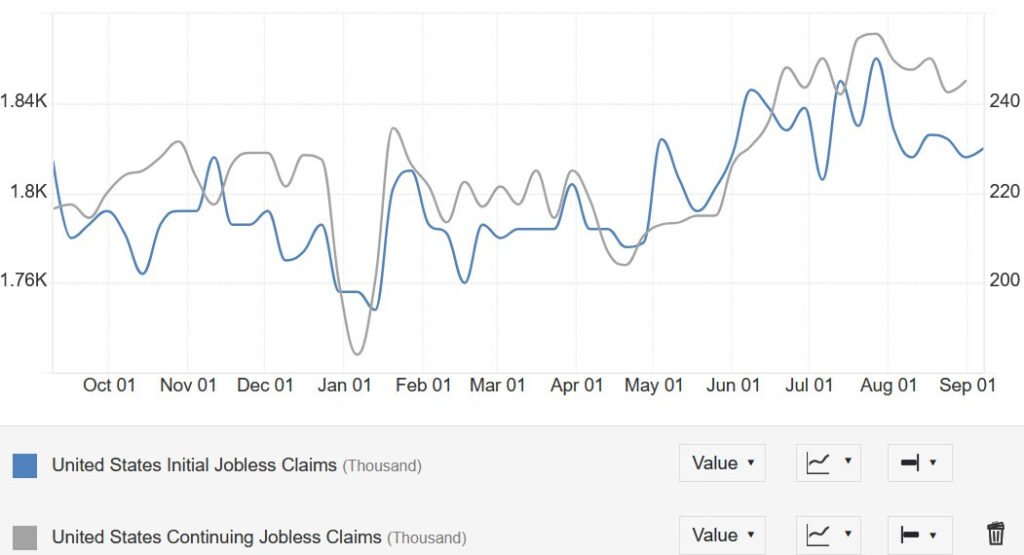

US Jobless Claims Weekly Update

- Initial Claims remain within 200K-260K range since 2022.

- Continuing Claims show sustained rise, indicating low layoffs and subdued hiring.

- Expected Initial Claims at 230K this week, compared to 230K prior.

- No consensus on Continuing Claims at the moment, with an increase to 1850K in the prior release.

Key Events on watch

USA

- 8:30 AM ET Weekly Jobless Claims

- 8:30 AM ET Continuing Claims

- 8:30 AM ET Current Account for Q2

- 8:30 AM ET Philly Fed Business Index

- 10:00 AM ET Existing Home Sales M/M

- 10:00 AM ET Leading Index M/M for August

- 10:30 AM ET Weekly EIA Natural Gas Inventory

Global

- New Zealand Q2 GDP,

- Australia Labour Market report,

- BoE Policy Decision,

- US Jobless Claims.

Other Key Events:

- BTIG Financial Services and Fintech Conference, 9/19 in New York

- Cantor Global Healthcare Conference, 9/17-9/19, in New York

- DA Davidson 23rd Annual Diversified Industrials and Services Conference, 9/18-9/20 in Nashville, TN

- Salesforce.com (CRM) Dreamforce Conference 9/17-9/19, in San Francisco, CA

Friday –Sep 20

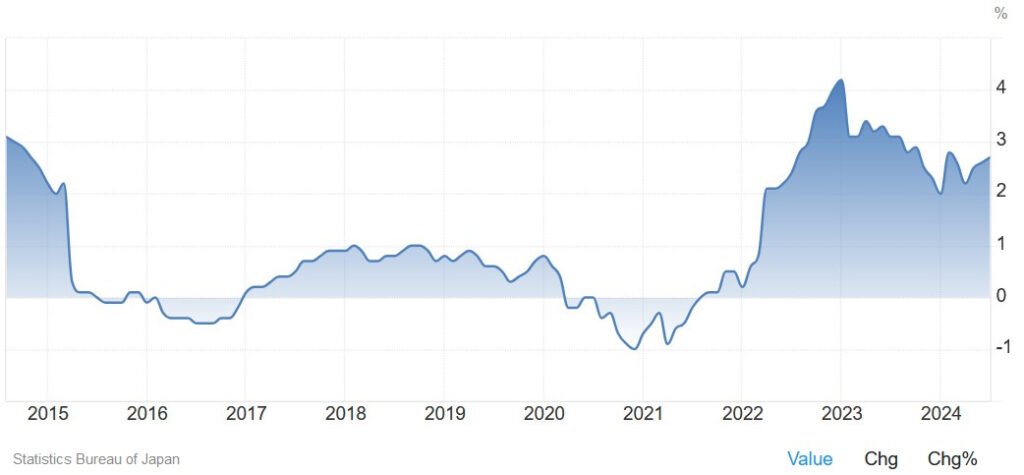

Japanese Core CPI Y/Y Expected at 2.8%

- Inflation and wage growth are key factors for the BoJ.

- BoJ expected to maintain rates, potentially delivering another rate hike by year-end.

BoJ’s Expected Interest Rates

- BoJ expected to maintain interest rates at 0.25%.

- Markets will monitor the Press Conference for potential rate hike signals.

- BoJ officials aim for a neutral policy stance.

- Market instability concerns are a major concern.

- BoJ may wait for the Fed’s easing cycle before further policy tightening.

PBoC Expected to Maintain LPR Rates

- 1 year LPR rates: 3.35%

- 5 year LPR rates: 3.85%

- Economic data: unfavorable

- High deflationary risks

- Importance of monetary policy easing

- Reduction of real rates from high levels.

Key Events on watch

USA

- 1:00 PM Baker Hughes Weekly rig count data

Global

- Japan CPI,

- PBoC LPR,

- BoJ Policy Decision,

- UK Retail Sales,

- Canada Retail Sales.

Other Key Events:

- DA Davidson 23rd Annual Diversified Industrials and Services Conference, 9/18-9/20 in Nashville, TN

Must read book about investing – check here

The US PPI Y/Y is expected to rise by 2.3%, while the M/M measure is expected to decrease by 0.1%. However, the sentiment will be set by the CPI report.